Hormuz threat ‘hasn’t dampened demand for Gulf LNG’

Gulf LNG exports are likely to keep attracting customers despite the lingering threat that Iran might close the Hormuz Strait, analysts say

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Commentary by Anne-Sophie Corbeau & Ann-Kathrin Merz • February 06, 2023

This commentary represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated.

Germany is facing a particularly complex equation: how to manage the halt of Russian pipeline gas supplies coupled with a strong increase in end-user gas prices for residential, commercial, and industrial consumers. The German regulator announced that a reduction of at least 20 percent of natural gas consumption would be needed to get through the winter;[1] this is higher than the EU’s voluntary target of 15 percent gas demand reduction over the period between August 2022 and March 2023.[2] In order to reduce Germany’s energy consumption while shielding consumers from high energy prices, the government announced in September 2022 a “protective shield” for which up to €200 billion (bn) would be available.[3] This commentary sheds light on the policy’s key measures for natural gas, exploring their strengths, shortcomings, and potential consequences.

As the largest European gas consumer (91 billion cubic meters in 2021) and the largest importer of Russian gas (52 percent of its gas supply), Germany has been particularly impacted by the drop in Russian gas deliveries. Since the halt of Russian gas flows on August 31, 2022, daily gross gas imports are about one-third lower than the average during the first half of 2022.[4]

High prices have already affected Germany’s gas consumption, which dropped by an estimated 17.6 percent in 2022[5] compared to 2021 (or by 14 percent, temperature-adjusted, against a 2018–2021 average). While this overall decline is well below the 20 percent target, the drop has been substantial since September, reaching 21 percent on average from September 2022 to December 2022 compared to the same period in 2021.[6] Industrial gas consumption[7] has dropped by 15 percent in 2022 and by 22 percent since early September, driven by energy efficiency, switching to cheaper oil products, and demand destruction.[8] Residential and commercial demand dropped by 12 percent in 2022, in part helped by a mild October (with a 39 percent drop in demand year over year), but also because consumers cut demand in response to high gas prices.[9]

In contrast, gas-fired power generation in Germany increased by only 2 percent in 2022.[10] The loss of German nuclear generation due to the decommissioning of three power plants at the end of 2021 was almost offset by an increase in coal-fired, solar, and wind generation, leading to a small increase in gas-fired generation in Germany. Gas-fired generation increased in the European Union (EU) as a whole.

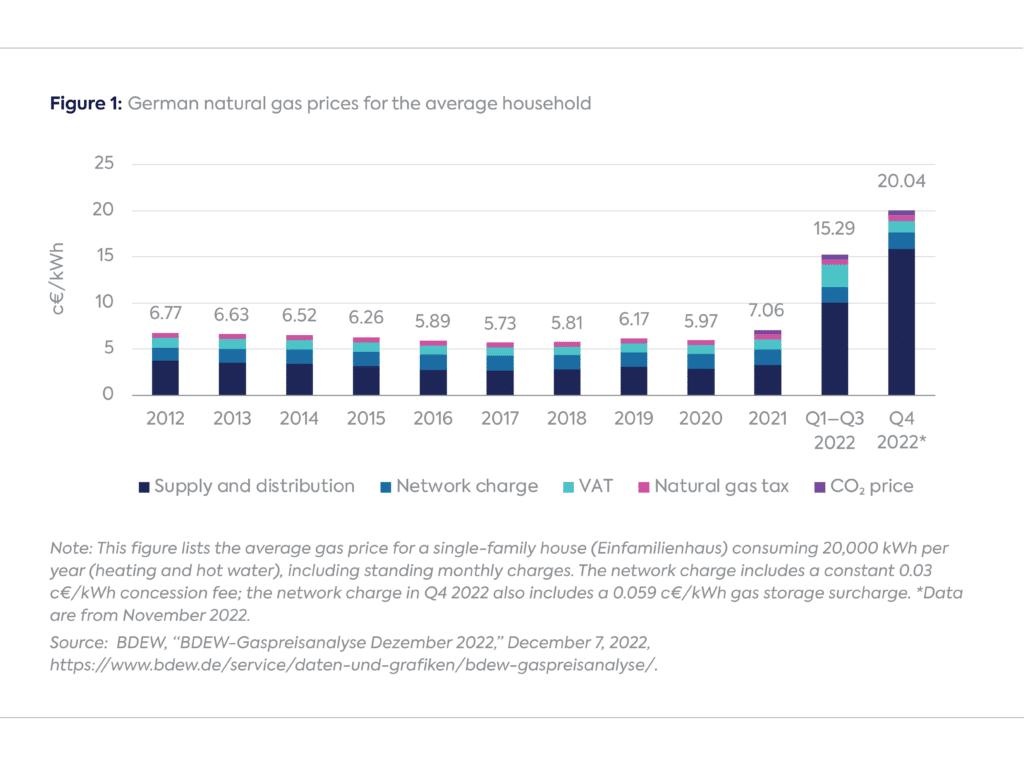

Almost half of German households used gas in 2019.[11] About half of Germany’s population lives in apartments with an average of around 45 square meters of living space and an average annual gas consumption of around 6,300 kilowatt-hour (kWh) per person.[12] Meanwhile around one-third of the population lives in single-family homes (Einfamilienhaus), which have an average annual gas consumption of 20,000 kWh (roughly consistent with three to four people living in the house).[13] The Bundesverband der Energie- und Wasserwirtschaft (BDEW) estimates that the average price of gas for a single-family home rose from 7.06 euro cents (c€)/kWh in 2021 to 20.04 c€/kWh as of Q4 2022 (see Figure 1). This means an individual living in an apartment went from paying around €450 for natural gas in 2021 to paying around €1,260 based on prices at the end of 2022, while the single-family home’s gas bill increased from around €1,400 to €4,000 over the same period. In this environment of high gas prices, there are also concerns about the future of the industrial sector: German chemical giant BASF announced it will permanently downsize its presence in Europe due to high energy prices.[14] These dramatic gas price increases and their consequences have attracted substantial political attention.

In September 2022, the German government promised a controversial[15] relief package that would cost €200 bn. Its aim, among other goals, was to shield consumers from high gas, power, and district heating prices while incentivizing energy consumption reduction.

This set of policies followed a variety of measures adopted by the German government since early 2022; however, the earlier measures, which are not part of the €200 bn package, cost less. These first interventions include the following:[16]

To quickly identify measures that would provide relief to gas and district heating consumers beyond those first interventions, the government created an independent expert commission for gas and district heating (ExpertInnen-Kommission Gas Wärme)on September 23, 2022. This 21-member committee[21] published two reports in October 2022, detailing measures to shield consumers and reduce gas consumption, as well as key topics, shortcomings, and additional policies needed to address the energy crisis.[22] The government used these reports to write a law, which was approved by the Bundesrat on November 14 and by the Bundestag on December 15.

The measures set out in the law are planned to last until the end of April 2024 and target household, commercial, and industrial users. Gas-fired power plants are excluded in order to avoid subsidizing gas-fired generation, which could result in a gas demand increase for power.[23] (Measures for power users will be implemented, but they are not described in this commentary.[24] Consumers using heating oil or pellets for heating are excluded.) The elements of the law meant to assist gas consumers have two main components:

Industry—around 24,000 to 25,000 companies with a gas consumption above 1.5 million kWh/y—will also be given relief with a price cap of 7 c€/kWh on 70 percent of their 2021-level gas consumption. The policy started in January 2023 and ends on April 30, 2024.

There are various estimates on how much elements of the gas price cap will cost given the uncertainty on price evolution. The government quotes €56 bn for the gas and district heating measures for residential users in 2023 and 2024. Another €8 bn will be given to health structures to help them face higher gas and power prices.[28]

Adhering to the European Union’s Temporary Crisis Framework (TCF) adds conditions to aid for industrial consumers. Maximum assistance is fixed at €150 million per “undertaking,” in line with the limit set by the EU’s Temporary Crisis Framework for energy-intensive industries in Annex 1.[29] It is worth noting that the TCF makes a distinction between several categories of companies regarding the aid given to compensate for additional costs due to exceptionally high natural gas and electricity prices; the aid is also proportional to the increase in energy costs, but the aid intensity and the maximum amount depend on the type of company.[30] To receive the full amount, a company must also have a decrease in the EBITDA (earnings before interest, taxes, depreciation, and amortization) in the eligible period by more than 40 percent relative to 2021 or a negative EBITDA without the relief. Moreover, its EBITDA in the eligible period, including the total aid received, must not exceed 70 percent of its EBITDA in 2021.[31]

Depending on the level of relief received, companies must also meet domestically mandated conditions intended to support social objectives. For companies to receive more than €2 million of relief for electricity, gas, and heating, they must maintain 90 percent of the number of employees on January 2023’s payroll through April 2025. This commitment can be achieved through a union-negotiated collective agreement (Tarifvertrag), a works council–negotiated agreement (Betriebsvereinbarung), or a written agreement.[32] The agreement must be delivered to the verifying authority (Prüfbehörde, not nominated as of mid-January 2023) by July 15, 2023. Companies are allowed to reduce their January 2023 workforce by up to 50 percent if 50 percent of the aid received flows toward long-term investment in the areas of energy transition or energy security meeting either the conditions of the EU Temporary Crisis Framework or the framework for the European Parliament’s sustainable investments.[33]

Finally, if a company receives between €25 and €50 million, its management may not receive new bonuses in the coming year.[34] If a company receives more than €50 million, neither bonuses nor dividends are permitted.[35] These controversial measures are a step down from the originally proposed blanket ban on bonuses and dividends, which intend to disincentivize dependence on aid.[36]

It is still too early to gauge the real impact of these measures in terms of consumption and whether all consumers will play their part to achieve the needed 20 percent reduction. But such a package of measures was designed by the expert commission to protect consumers and also economically incentivize demand reduction by making consumption above 80 percent of the previous year’s level more expensive. Similar measures can be found in Austria[37] and in the Netherlands.[38] This package of measures might have better outcomes in terms of energy savings than reduced tariffs covering all consumption, as a blanket tariff reduction shields consumers but does not incentivize demand reduction. It might similarly have better outcomes than requiring commercial entities and recommending households to keep the indoor temperature at 19°C during winter, especially if there is no monitoring and financial sanction in case of a breach.

But one of the biggest flaws of this policy is that a wealthy family with a massive home and historically excessive energy consumption will be a greater recipient of government funds in absolute terms than a family at the edge of poverty who is consuming the bare minimum to begin with. In other words, subsidizing energy consumption for all consumers creates a poorly targeted policy, as less money flows to the lower-income households whose burden from rising energy costs as a percentage of disposable income is greater. Such flaws are common among EU countries’ policies that are rolled out quickly to all consumers in the name of relief.[39]

Governments may also lack the data and/or state infrastructure to implement socially differentiated direct payments that couple revenues with heating methods and consumption. To add a socially differentiated element to relief measures, policy makers would need to link assistance to income thresholds. This type of strategy is similar to Germany’s already existing solidarity surcharge, which, as of 2019, is only paid by the top 10 percent of earners.[40] Some governments may argue, however, that the administrative burden of these types of measures is high.

Additionally, the gas price of 12 c€/kWh for households is still well above 7.06 c€/kWh, the price in 2021. To put things in perspective, the German gas import price in Q3 2022 was 12.7 c€/kWh,[41] and current forward prices point to a tight situation until 2026.[42] This means that households will still experience a significant increase in their gas bills, which might not be fully compensated by other allowances that the government put in place earlier in 2022. Meanwhile, the one-time payment in December will have helped those who had not yet seen their tariffs increase.

These measures have tried to capture various cases across the German population, from homeowners to tenants, from those living in houses to flats in large buildings. It foresees that those living in buildings where the owner pays the energy bills will get a rebate on their rental bills. However, the rebate may only be given in 2023 when the accounts for 2022 are finalized. Also, whether the tenant gets the one-time payment depends on whether the homeowner has already increased the gas or district heating costs in the monthly charges. Additionally, many buildings with several flats (Mehrfamilienhaus) do not have individual meters. Only the supplier and the landlord know the consumption of the entire building, making the landlord responsible for splitting the cost among tenants. Given that tenants do not know the details of their consumption or the gas contracts, there might be a lack of transparency in this process, which would require monitoring to make sure tenants get the rebate. There is also the issue of whether the landlord transfers the rebate quickly or through the annual settling of accounts of additional costs between the tenant and landlord that must occur within 12 months after the end of the calendar year.[43] Finally, individual users are not rewarded for reducing their consumption if other residents do not share the burden.[44] Such an issue could be tackled by a mandatory installation of (smart) individual meters in each flat, which the government could subsidize.[45] The government could also incentivize transformational investments that reduce demand (e.g., insulation and heat pumps).

The recently approved policies only provide support until April 2024, while forward prices point to a difficult situation until 2026. Therefore, the measures may have to be extended by at least another year, at a significant cost for the German budget. But while €200 bn is equivalent to around 5 percent of Germany’s gross domestic product and the country has a debt ratio of around 69 percent, not all European countries (some of which already boast a high fiscal deficit) may be able to support their households and industries in a similar fashion. This is why a few European countries, such as Italy and France, protested when Germany announced the plan, as their fiscal situation does not enable them to replicate similar measures. The fact that Germany has recently been trying to relax state aid rules further worries many European countries.[46]

The EU industrial sector is facing unique challenges due to this energy crisis while trying to decarbonize, which may require a new industrial master plan at an EU level rather than a country level.[47] The German industrial sector is a key part of the country’s economy: according to the Federal Ministry for Economic Affairs and Climate Action, it “plays a much stronger role as a driver of growth, prosperity, and employment in Germany than in other countries that share many characteristics with Germany.”[48] Not all parts of German industry (or EU industry in general) have been hit equally. Differences depend on whether contracts already reflect higher costs in addition to sectoral activity. Some industrial users are facing competition from other regions with lower energy costs, which has prompted a few companies (such as BASF) to consider relocating their businesses to these regions. The higher the proportion of energy costs in the cost of the final product, the more at risk these industries may be. This is why fertilizer producers, for example, have been dramatically reducing their operations.[49] Other industrial users, including small and medium enterprises, may serve more local markets and face the choice of either increasing the price of their products or stopping activities if they cannot pass on these costs or reduce their energy consumption significantly.

Germany’s gas supply problems are unique given the sheer amount of Russian pipeline gas that needs to be replaced. The “protective shield” put in place by the German government stands out in terms of the amount of money involved, which is greater than what any other EU country has announced and reflects the government’s will to protect all consumers, including industrial users, but remain within the EU’s Temporary Crisis Framework. These measures provide important relief; however, they are not designed to focus efforts on low-income consumers.

Germany has to be successful in significantly reducing its gas demand and protecting its industry or risks additional domestic and regional challenges. A failure to reduce gas demand would have ripple effects on other EU countries’ gas balances, while a failure to protect the industry would have strong economic implications given its importance to Germany’s economy. Germany has more financial means to protect its consumers than any other European country, but its success will be a double-edged sword: Germany might be able to protect its consumers and economy, but other EU countries may not have the financial strength to replicate this effort.

[1] Federal Ministry for Economic Affairs and Climate Action, “FAQ Liste—Notfallplan Gas,” June 23, 2022, https://www.bmwk.de/Redaktion/DE/Downloads/F/faq-liste-notfallplan-gas.pdf?__blob=publicationFile&v=10.

[2] European Council, “Member States Commit to Reducing Gas Demand by 15% Next Winter,” July 26, 2022, https://www.consilium.europa.eu/en/press/press-releases/2022/07/26/member-states-commit-to-reducing-gas-demand-by-15-next-winter/.

[3] Bundesregierung, “A Shield to Protect the Economy against the Consequences of Russia’s War of Aggression,” October 5, 2022, https://www.bundesregierung.de/resource/blob/998440/2131852/626fb5cfc0537be3daf85affe8cc1864/2022-10-05-courtesy-translation-en-data.pdf?download=1.

[4] Bundesnetzagentur, “Gasversorgung,” accessed December 18, 2022, https://www.bundesnetzagentur.de/DE/Gasversorgung/aktuelle_gasversorgung/_svg/Gasimporte/Gasimporte.html?nn=1077982.

[5] Bundesnetzagentur, “Rückblick: Gasversorgung im Jahr 2022,” January 6, 2023, https://www.bundesnetzagentur.de/DE/Gasversorgung/aktuelle_gasversorgung/Rueckblick/start.html.

[6] Bundesnetzagentur, “Gasverbrauch—Temperaturbereignigt,” accessed January 23, 2022, https://www.bundesnetzagentur.de/DE/Gasversorgung/aktuelle_gasversorgung/_svg/Gasverbrauch_Gesamt_monatlich/Gasverbrauch_Gesamt_2023.html?nn=1077982.

[7] Industrial consumption includes data for around 40,000 consumers who typically have a consumption higher than 1.5 GWh. This also includes the data for gas-fired power plants.

[8] Federal Ministry for Economic Affairs and Climate Action, “ExpertInnen-Kommission Gas Wärme Zwischenbericht,“ October 10, 2022, https://www.bmwk.de/Redaktion/DE/Publikationen/Energie/expertinnen-kommission-gas-und-waerme.html.

[9] Auguste Breteau, “German Weather-Adjusted Gas Demand Sinks,” Argus Media, November 7, 2022, https://www.argusmedia.com/en/news/2388487-german-weatheradjusted-gas-demand-sinks.

[10] European Network of Transmission System Operators for Electricity, Transparency Platform, accessed January 8, 2023, https://transparency.entsoe.eu.

[11] Federal Ministry for Economic Affairs and Climate Action, “So Heizen die Deutschen,” November 12, 2019, https://www.bmwi-energiewende.de/EWD/Redaktion/Newsletter/2019/10/Meldung/direkt-erfasst_infografik.html. One-quarter of households are using oil, 14 percent are using district heating (powered by either coal, gas, or waste), and 5 percent are using electricity. This is much lower than in the United Kingdom (86 percent; see Ministry of Housing, Communities and Local Government, “English Housing Survey,” 2021, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1055629/Energy_Report_2019-20.pdf) and in the Netherlands (over 90 percent; see CE Delft, “The Natural Gas Phase-Out in the Netherlands,” February 2022, https://ce.nl/wp-content/uploads/2022/04/CE_Delft_210381_The_natural_gas_phase-out_in_the_Netherlands_DEF.pdf).

[12] Bosch, “Durchschnittlicher Gasverbrauch in Wohnungen,” accessed December 15, 2022, https://www.bosch-thermotechnology.com/de/de/wohngebaeude/wissen/heizungsratgeber/gasheizung/gasverbrauch/#null. The average consumption for one person living alone in a building is 140 kWh per square meter.

[13] Deutschland.de, “Wie Deutschland Wohnt,” March 24, 2021, https://www.deutschland.de/de/topic/leben/lifestyle-kulinarik/wie-deutschland-wohnt.

[14] Patricia Nilsson, “BASF to Downsize Permanently in Europe,” Financial Times, October 26, 2022, https://www.ft.com/content/f6d2fe70-16fb-4d81-a26a-3afb93e0bf57.

[15] Suzanne Lynch, Paola Tamma, Hans von der Burchard, and Hannah Roberts, “Tensions Flare over the EU’s New Irresponsible Big Spender: Germany,” Politico, October 3, 2022, https://www.politico.eu/article/tensions-flare-over-the-eus-new-irresponsible-big-spender-germany/.

[16] €130 million based on Tagesschau, “Mindestens 135 Euro Heizkostenzuschuss,” January 21, 2022, https://www.tagesschau.de/wirtschaft/verbraucher/heizkostenzuschuss-101.html; Die Bundesregieriung, “Die Entlastungen Greifen Jetzt,” June 13, 2022, https://www.bundesregierung.de/breg-de/aktuelles/entlastungspaket-2026602.

[17] Die Bundesregierung, “Stromkunden Werden Entlastest,” May 28, 2022, https://www.bundesregierung.de/breg-de/suche/eeg-umlage-faellt-weg-2011728.

[18] Bundesfinanzministerium, “Steuerentlastungen Unterstützen Bürger*innen,” March 16, 2022, https://www.bundesfinanzministerium.de/Content/DE/Pressemitteilungen/Finanzpolitik/2022/03/2022-03-16-steuerentlastungen-unterstuetzen-buergerinnen.html.

[19] RND, “135 Euro für Alleinlebende: Kabinett Beschließt Heizkostenzuschuss,” February 2, 2022, https://www.rnd.de/politik/heizkostenzuschuss-135-euro-fuer-alleinlebende-beschlossen-TBUDPXSQ6H663ZESLWDM5CKNZU.html; Tagesspiegel, “Für Menschen mit Geringem Einkommen: Kabinett Billigt Heizkostenzuschuss für 2.1 Millionen Bürger,” February 2, 2022, https://www.tagesspiegel.de/politik/kabinett-billigt-heizkostenzuschuss-fur-21-millionen-burger-6596278.html.

[20] Bundesfinanzministerium, “FAQ Temporäre Senkung des Umsatzsteuersatzes auf Gaslieferungen über das Erdgasnetz,” November 14, 2022, https://www.bundesfinanzministerium.de/Content/DE/FAQ/2022-11-14-FAQ-temporaere-Senkung-USt-Gas.html; Bundestag, “Bundestag Senkt Befristet Umsatzsteuer auf Gas auf Sieben Prozent,” accessed December 10, 2022, https://www.bundestag.de/dokumente/textarchiv/2022/kw39-de-umsatzsteuer-gaslieferungen-911418.

[21] The committee is led by three individuals representing the academic, corporate, and union perspectives.

[22] Federal Ministry for Economic Affairs and Climate Action, “ExpertInnen-Kommission Gas Wärme Zwischenbericht“; Federal Ministry for Economic Affairs and Climate Action, “ExpertInnen-Kommission Gas Wärme Abschlussbericht,“ October 31, 2022, https://www.bmwk.de/Redaktion/DE/Publikationen/Energie/abschlussbericht.html.

[23] Federal Ministry for Economic Affairs and Climate Action, “FAQ-Liste zur Wärme- und, Gaspreisbremse,” December 16, 2022, https://www.bmwk.de/Redaktion/DE/Downloads/F/faq-gaspreisbremse.pdf?__blob=publicationFile&v=10.

[24] Measures on the power side are projected to cost between €66 and €82 bn (Julian Olk, “Strompreisbremse und Gaspreisbremse—Was Sie Wissen Sollten,” Handelsblatt, November 18, 2022, https://www.handelsblatt.com/politik/deutschland/entlastungen-im-ueberblick-strompreisbremse-und-gaspreisbremse-was-sie-wissen-sollten/28783020.html).

[25] Only consumers with an annual gas consumption below 1.5 million kWh received this one-time payment in December. Industrial consumers with an annual gas consumption above 1.5 million kWh will receive only the gas price reduction from January 2023 onward.

[26] The amount consumers will receive is 1/12 ´ annual consumption forecast as of September 2022 (in kWh) ´ gas price of December 2022 (in €/kWh) + 1⁄12 annual standing charge as of September 2022 (in €).

[27] Lundquist Neubauer, “Gaspreisbremse Könnte Gaskosten um über 40 Prozent Senken,” Verivox, October 10, 2022, https://www.verivox.de/gas/nachrichten/gaspreisbremse-koennte-gaskosten-um-ueber-40-prozent-senken-1119811/.

[28] Bundestag, “Studierenden-EnergiepreisPauschale Beschlossen, Strom- und Gaspreisbremse Erörtert,” December 1, 2022, https://www.bundestag.de/dokumente/textarchiv/2022/kw48-de-gaspreisbremse-923066. See also Klaus Stratmann, “Wie die Industries die Preisbremsen Noch Aendern Will,” Handelsblatt,December 6, 2022, https://www.handelsblatt.com/politik/deutschland/strompreisbremse-und-gaspreisbremse-wie-die-industrie-die-preisbremsen-noch-aendern-will/28849486.html.

[29] European Commission, “Overview for Support Possibilities under Section 2.4 Temporary Crisis Framework,” October 28, 2022, https://competition-policy.ec.europa.eu/system/files/2022-10/TCF_Overview_of_support_options.pdf.

[30] Energy-intensive industries are defined as industries whose purchases of energy products (including energy products other than natural gas and electricity) amount to at least 3.0 percent of the purchase of the production value or turnover, based on data from the financial accounting reports for the calendar year 2021. Annex 1 companies refer to those that are active in sectors at risk of carbon leakage. For energy-intensive companies in Annex 1, the aid is limited to 80 percent of the maximum eligible costs. See European Commission, “Overview for Support Possibilities under Section 2.4 Temporary Crisis Framework,” October 28, 2022, https://competition-policy.ec.europa.eu/system/files/2022-10/TCF_Overview_of_support_options.pdf.

[31] Bundestag, “Studierenden-EnergiepreisPauschale Beschlossen, Strom- und Gaspreisbremse Erörtert.”

[32] Constanze Mercedes Merkelbach-Scholtka and Jacqueline Volmari, “Arbeitsplatzerhaltungspflicht Aufgrund von Energiepreisbremsen,“ Pusch Wahlig Workplace Law, December 22, 2023, https://pwwl.de/arbeitsplatzerhaltungspflicht-aufgrund-von-energiepreisbremsen/ (translation according to the International Labour Organization). “Collective Agreements” refers to “Tarifverträge” negotiated at the branch level by the appropriate labor unions or employers’ associations. “Works Agreements” refers to “Betriebsvereinbarung” concluded between the employer and the works council (Lilijane Jung, “National Labour Law Profile: Federal Republic of Germany,” International Labour Organization, April 2001, https://www.ilo.org/ifpdial/information-resources/national-labour-law-profiles/WCMS_158899/lang–en/index.htm).

[33] Julian Olk and Klaus Stratmann, “Ampel Bringt Preisbremse für Öl-, Pellet- und Flüssiggas-Heizkosten auf den Weg,” Handelsblatt, December 12, 2022, https://www.handelsblatt.com/politik/deutschland/bundestag-ampel-bringt-preisbremse-fuer-oel-pellet-und-fluessiggas-heizkosten-auf-den-weg/28863316.html; Bundestag, “Gesetzentwurf der Fraktionen SPD, BÜNDNIS 90/DIE GRÜNEN und FDP,” November 29, 2022, https://dserver.bundestag.de/btd/20/046/2004683.pdf; Bundestag, “Gesetzentwurf der Fraktionen SPD, BÜNDNIS 90/DIE GRÜNEN und FDP,” November 29, 2022, https://dserver.bundestag.de/btd/20/046/2004685.pdf.

[34] Federal Ministry for Economic Affairs and Climate Action, “FAQ-Liste zur Wärme- und, Gaspreisbremse.” This prohibition only applies to bonus agreements that have been or should be concluded after December 1, 2022.

[35] Ibid.

[36] Bundestag, “Studierenden-EnergiepreisPauschale Beschlossen, Strom- und Gaspreisbremse erörtert,” December 1, 2022, https://www.bundestag.de/dokumente/textarchiv/2022/kw48-de-gaspreisbremse-923066.

[37] Johannes Weichhart, “Strompreisrabatt in NÖ Fix: 11 Cent pro Kilowattstunde,” July 20, 2022, https://kurier.at/chronik/niederoesterreich/kein-warten-auf-den-bund-so-funktioniert-der-strompreisdeckel-in-noe/402081403.

[38] Business.gov.nl, “Help with Energy Bills SME (Price Cap),” accessed December 9, 2022, https://business.gov.nl/amendment/help-energy-bills-sme/. Only consumption up to 1,200 cubic meters is subsidized.

[39] For example, France capped regulated gas prices in October 2021, allowing for no more than a 4 percent rise per year; regulated gas prices will increase by 15 percent in 2023. In the United Kingdom, Rishi Sunak’s government announced an energy price guarantee starting on October 1, 2022, so that households with typical energy use in Great Britain would pay an average gas and power bill of around £2,500/y until March 31, 2023, and around £3,000/y until March 31, 2024.

[40] Jan Hildebrand and Julian Olk, “Wer die Ersparnis aus der Entlastung Versteuern Muss,” Handelsblatt, November 29, 2022, https://www.handelsblatt.com/politik/deutschland/gaspreisbremse-wer-die-ersparnis-aus-der-entlastung-versteuern-muss/28826820.html.

[41] Bafa, “Erdgasstatistik,” accessed January 6, 2023, https://www.bafa.de/DE/Energie/Rohstoffe/Erdgasstatistik/erdgas_node.html.

[42] The ICE, “Dutch TTF Natural Gas Futures,” accessed January 6, 2023, https://www.theice.com/products/27996665/Dutch-TTF-Gas-Futures/data.

[43] Focus, “Auszahlung im Dezember Geld Zurück vom Vermieter: Diesen Effekt Hat die Gaspreisbremse Kurzfristig-für-Sie,” December 2022, https://www.focus.de/wissen/auszahlung-im-dezember-geld-zurueck-vom-vermieter-diesen-effekt-hat-die-gaspreisbremse-kurzfristig-fuer-sie_id_175476644.html.

[44] Kathrin Witsch, “Gaspreise Steigen seit Kälteeinbruchanhaltend,” Handelsblatt, December 2, 2022, https://www.handelsblatt.com/unternehmen/energie/gaspreisentwicklung-gaspreise-steigen-seit-kaelteeinbruch-anhaltend-/28682942.html.

[45] Germany has explored some similar programs, though mostly related to power; see Nikolaus J. Kurmayer, “Germany Announces ‘Acceleration’ of Smart Meter Rollout,” updated January 17, 2023, https://www.euractiv.com/section/electricity/news/germany-announces-acceleration-of-smarter-meter-rollout/.

[46] Jonathan Packroff and Oliver Noyan, “Germany Under Fire for Push to Revamp EU Subsidy Rules,” Euractiv, January 16, 2023, https://www.euractiv.com/section/politics/news/germany-under-fire-for-push-to-revamp-eu-subsidy-rules/?_ga=2.121036303.681492761.1673854125-556436987.1673531557.

[47] Fatih Birol, “Europe Urgently Needs New Industrial Master Plan,” LinkedIn, December 7, 2022, https://www.linkedin.com/pulse/europe-urgently-needs-new-industrial-master-plan-fatih-birol/.

[48] Federal Ministry for Economic Affairs and Climate Action, “A Modern Industry Policy,” accessed January 10, 2023, https://www.bmwk.de/Redaktion/EN/Dossier/modern-industry-policy.html.

[49] Yara, “Yara Implements Further Production Curtailments in Europe,” August 25, 2022, https://www.yara.com/corporate-releases/yara-implements-further-production-curtailments-in-europe/.

The conflict between Iran, Israel, and now the United States has yet to disrupt energy supplies to global markets. However, the US decision to attack Iran's nuclear program...

A nuclear energy resurgence is vital to meet rising electricity demand.

Full report

Commentary by Anne-Sophie Corbeau & Ann-Kathrin Merz • February 06, 2023