Private equity groups have been increasingly active in financing energy projects in the US. KKR, a US investment firm, launched its Real Asset’s Energy Platform in 2012. The platform has since become a major player in asset-based oil and gas investing and today manages over $8.5 billion in energy and infrastructure related assets.

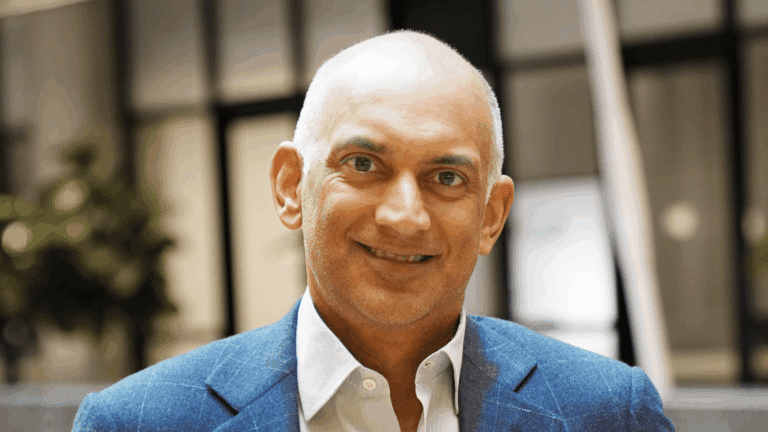

On a new episode of Columbia Energy Exchange, host Jason Bordoff sits down with Claire Farley, who serves as Vice Chair of Energy, advising KKR’s Energy Group. Prior to joining KKR in 2011, Ms. Farley was Co-Founder and Co-CEO of RPM Energy LLC, a privately-owned oil and natural gas exploration and development company, which partnered with KKR. Throughout her career, Claire has held numerous roles in the oil and gas industry and started her career at Texaco.

Claire and Jason caught up in Houston to discuss her views on the outlook for the energy industry, particularly shale oil and gas, and how private equity investors work around the cyclical nature of the industry.

Other topics include the underrepresentation of women in the oil and gas industry; the role that private capital can play in investing in clean energy and ‘impact investing’, the role that technology can play in the industry (e.g. artificial intelligence and re-fracking), and the growing demand for low carbon energy sources.