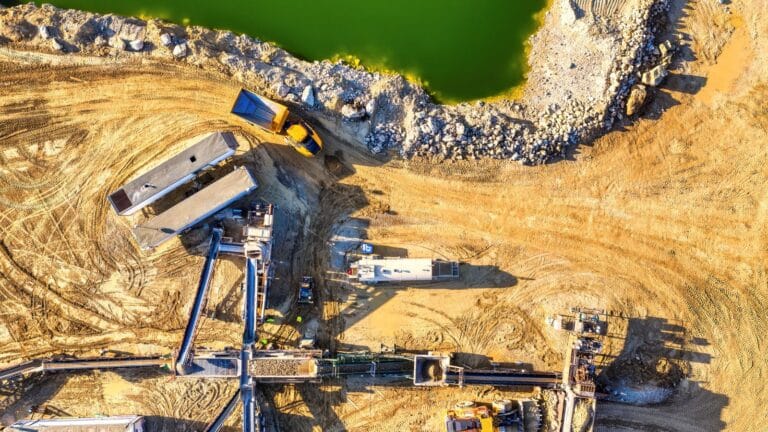

Russia’s oil and natural gas commodities get a lot of attention, but the country’s critical metals and minerals supplies – which include steel, titanium, nickel, cobalt and lithium – are also cause for concern.

Moscow’s military invasion of Ukraine could disrupt the global supply of these materials, which can be found in every corner of our lives. Notably, these minerals are essential components of clean energy technologies like solar panels, wind turbines and batteries for electric vehicles.

For a look at how global supply chains of critical minerals will be crucial to the energy transition – and how these supply chains can be managed effectively – host Bill Loveless spoke with Abigail Wulf. She’s the Vice President and Director of Critical Minerals Strategy at SAFE, a nonpartisan organization that promotes U.S. energy security policies.

Previously, she was a Senior Science Communicator at NASA where she worked to promote NASA’s Earth Science research.

In this conversation, they discuss the implications of the war for critical mineral supply chains, China’s control over mineral processing facilities and steps the US government could take to develop sustainable mining projects.

Transcript

Abigail Wulf: [00:00:03] Geologically speaking, the United States could never do all of this on our own. And so again, it’s it always devolves into minor, don’t mind politically, but again, it’s just, you know, we can’t. We only have like point one percent of nickel reserves in this country. So of course, you know, you’re not going to get all of your nickel from the United States that you’re going to need for your electric vehicles. [00:00:23][20.3]

Bill Loveless: [00:00:24] Russia’s oil and natural gas commodities are well known, but the country is also a force to be reckoned with when it comes to critical minerals. Russia controls vast supplies of everything from titanium to nickel to cobalt and lithium, and its military invasion of Ukraine could disrupt the global supply of these materials. Ukraine is important, too, for its iron, manganese and neon. How can global supply chains of critical minerals crucial to the energy transition be managed in the wake of war and market disruptions? This is Columbia Energy Exchange, a weekly podcast from the Center on Global Energy Policy at Columbia University. I’m Bill Loveless. Today on the show, Abigail Wulf, she’s the vice president and director of Critical Minerals Strategy at Safe, formerly known as Securing America’s Future Energy Safe, is a nonpartisan organization of prominent military and business leaders that promotes policies to improve U.S. energy security. Previously, she was a senior science communicator at NASA, where she worked collaboratively to develop strategies to promote NASA’s Earth science research to policymakers and the public. Earlier in her career, she and I had similar jobs as she was a science policy reporter. Abigail and I discuss the war’s implications for critical minerals supply chains, China’s dominance of the mineral processing industry and steps the U.S. government could take to develop domestic mining projects. Hope you enjoy. Abigail Wolfe, welcome to Columbia Energy Exchange. [00:02:11][107.4]

Abigail Wulf: [00:02:12] Thank you so much for having me here today, Bill. Excited to be on. [00:02:15][2.5]

Bill Loveless: [00:02:15] Well, we’re happy to have you here. It’s an important discussion, one you’ve been very much involved in. But first, tell us a little bit about yourself. What interests you and how you got into this line of work? [00:02:27][12.4]

Abigail Wulf: [00:02:28] Yeah. So I am the director for the ambassador, Alfred Hoffman Center for Critical Minerals Strategy at a nonpartisan, nonprofit think tank organization called Safe that’s based in Washington, DC. I’ve been interested in, you know, what I like to call Natural Security for a pretty long time. I studied geology, actually as an undergraduate in college and have worked in various Earth science related organizations throughout my professional career. But it was really back in 2010 and 2011 when I was studying pragmatists, which is the type of igneous rock enriched in rare Earth elements and lithium. Witte Thank you. Yeah. When? Yes, exactly. And what’s the favorite thing? And so it was back during that time, a little over a decade ago when China first cut off supplies of rare Earth elements to Japan back over a dispute over the Senkaku Diaoyu, or I’m going to butcher that islands in the East China Sea. And so pragmatists which are enriched in rare Earth elements. My my government thesis advisor was like, Oh, you know, what are what do you know about rare earths? And I was like, Oh, well, they’re in my bag mutate. And he was like, Do you know what’s happening with China? And so, you know, the rest is sort of history. [00:03:42][74.0]

Bill Loveless: [00:03:43] One thing leads to another. I was going to ask you, I saw in your biography that you had studied these lithium rich palmitate, and I was going to ask you what they were. I also noticed in your background that you once were a reporter and as a former reporter myself, I was pleased to see that. [00:03:58][15.8]

Abigail Wulf: [00:03:59] That’s right. Right out of college, got to work for Earth magazine and cover all sorts of things, including actually and again relevant. The SEC’s decision in 2012 to include Section 15 Oh two and Dodd-Frank for the three tag elements which we can talk about a bit later for transparency. But yeah, it was a fun time. [00:04:17][18.4]

Bill Loveless: [00:04:18] Yeah. A good foundation for the work you’re doing now. Well, we’ve we’ve talked about this topic before on this show, but to refresh our memories, Abby, what are critical minerals and why are they important to the transition to a cleaner energy world? [00:04:32][14.2]

Abigail Wulf: [00:04:33] So critical minerals are defined differently by different countries. But the U.S. Department of the Interior has just updated its list of critical minerals. And essentially, it’s a mixture of how import reliant we are on these things and also how they are used for our economy and national security is sort of what they used in their methodology to determine these critical minerals. They also recently updated that methodology to include how willing other countries are to give us these materials also based on our import reliance. So right now, you know, the United States is over 50 percent import reliant for the majority of the battery metals, except for copper and lithium. And you know, a lot of the countries where these are concentrated and don’t necessarily share our interests and values. And so as you know, we’re all in this sort of frantic rush trying to figure out how to secure the supplies of these things as our economy and our lives become more electric. [00:05:31][58.4]

Bill Loveless: [00:05:32] Yeah. And I didn’t appreciate that the understand that these lists are updated periodically. I was reading that the Energy Act of 2020 contains a definition of critical minerals as something it’s a non-fuel mineral or a mineral material essential to the economic or national security of the United States, and which has a supply chain vulnerable to disruption, as you as you just explained. You know, they’re also characterized as serving an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economy of the national security. And that’s a description from the U.S. Geological Survey. Exactly. Well, you know, these concerns over the risks associated with supplies of critical minerals have been around for quite some time now. You studied it for years, as you mentioned, you recall that incident between China and Japan and back in 2010. But these risks are getting that much more attention these days in light of what’s been happening with the war in Ukraine. Why is that so [00:06:40][68.0]

Abigail Wulf: [00:06:41] the war in Ukraine is really putting an increased emphasis on what it means to be over reliant on certain things that are necessary for our economy, on national security, on countries that don’t share our interests and values, and in ways that countries aren’t able to make decisions in their best interest. So for example, right now with Russia’s war on Ukraine, what is happening is European Union, the United States and other Naito and allied nations are trying to figure. Are out ways that we can counter this Russian aggression. But what they’re finding is are their overreliance on Russian oil and gas is making them so they are unable to make the the strongest sort of stands that they want to make. The European Union is 40 percent import reliant on Russian gas. The European Union’s largest economic powerhouse, Germany, is more than two thirds reliant for that Russian gas. And so, you know, they’re they’ve announced that they they are stopping the Nord Stream two for now, but they’re still very heavily reliant on this energy source and they don’t have, you know, the LNG terminals that they need. So the United States, you know, has announced that we’re going to be sending them more liquefied natural gas, but getting them that gas is still an issue. So, you know, we’re seeing that today this issue was over oil, but tomorrow it could be over our supply chains for clean energy because we see this electric transition is happening. It’s really only a matter of time and it’s safe. You know, we we we argue that if we had made this transition to electricity a decade ago, then we wouldn’t be in this position here today. And that’s something that Steve has been advocating for for quite a long time. So again, formally securing America’s future energy, our original mandate and our original mission was to try to wean the United States off of unreliable sources of oil, because this this notion of energy independence is sort of a mirage. We actually just recently put out a paper on that exact topic. We are tied into these international energy markets. As you can see right now, the United States only imports about four percent of our oil and gas from Russia. But the impact that it’s having on our pumps is just as much as it’s going on everywhere else. So, you know, we wanted we wanted to make sure a decade decades ago that we were weaning ourselves off of this, you know, OPEC manipulated Kremlin manipulated oil markets to something more steady for our transportation sector electrification, but also don’t want to be pivoting away from OPEC and oil and straight into that right now, the Chinese Communist Party and critical minerals. [00:09:21][160.9]

Bill Loveless: [00:09:22] Right. And as you mentioned, most of the discussion lately has been over oil and gas and coal, for that matter. The imports of those materials from Russia by Europe and other countries. But critical minerals, you say that down the road, the concern may be more over the reliance on critical minerals from places like Russia. Let’s talk about Russia and even Ukraine in terms of what, what they supply, what they mined or what they provide when it comes to critical metals and minerals. [00:09:58][35.9]

Abigail Wulf: [00:09:59] Yeah, so so the big thing that everyone’s talking about right now is Russia’s role in the nickel market. So Russia controls about 20 percent of the world’s class one nickel. That’s nickel that is highly refined and pure to like 98 99 percent purity that’s used in steel or alloys and also very important for battery production. You know, a lot of battery chemistries today for lithium ion batteries are NMC. That’s nickel, cobalt and manganese. And you know, people are trying to get cobalt out of out of batteries, which means you’re going to add more nickel. So nickel is really going to be a very huge deal as we go into, you know, more electric vehicles on the roads. But although Russia controls 20 percent of the Class one nickel market, it really doesn’t have a monopoly on global nickel reserves. Russia only has about seven and a half percent of nickel reserves, and it actually only accounts overall for about 10 percent of global nickel production. Indonesia and China are much larger players in the nickel space. But, you know, other other materials that we also get from Russia that people are talking about are palladium, you know, palladium a much bigger deal in traditional internal combustion engine vehicles for catalytic converters. So that sort of going down, but also very critical in the semiconductor industry as well. We got a lot of polysilicon actually from Russia as well. They’re right behind China in our polysilicon global production and polysilicon is what you know the world’s solar panels are made out of and also quite remarkably. Russia is second in cobalt production as well, behind China. So there are a few things that we do get from them. But that’s not to say that we won’t be able to get things from other places as well. [00:11:43][104.2]

Bill Loveless: [00:11:43] Right. But nevertheless, you think it’s it’s it’s a matter of concern that Russia, it does supply these materials to the extent that it does. [00:11:50][7.0]

Abigail Wulf: [00:11:51] It again is just opening our eyes to where we’re getting these things from. I think that most people are just understanding that the things that we use in our everyday lives are either grown or their mind, at least in one point in time. And hopefully recycling will be playing a much larger role in that as we go forward. You can’t make something you can’t make something out of nothing, I should say. And so I think that everyone you know, people don’t read the USGS as mineral commodity summaries as religiously as I do when they come out every year. And so now I think that’s going to be a much hotter publication going forward for people. [00:12:23][31.7]

Bill Loveless: [00:12:24] But I have to be honest, I poured through it much more carefully than I’ve ever done before and appreciate the updates that have taken place there. [00:12:30][6.2]

Abigail Wulf: [00:12:31] It’s such a lovely document. I really love that document. [00:12:34][3.4]

Bill Loveless: [00:12:35] Yeah, yeah. And it certainly is an important one. You know, Ukraine has a long tradition of mineral production, too. I understand, you know, having been a major producer of iron and manganese or as well as titanium, phosphorus and rare earth elements, and also holds a number of gold deposits. To what extent do we pay attention to Ukraine when it comes to these minerals? And how might the war have an impact on those supplies to other countries? [00:13:03][28.8]

Abigail Wulf: [00:13:04] The biggest thing right now out of the materials we’re getting for Ukraine that is of the most concern is actually neon, one of the noble gases. And so neon is used in the production of semiconductors. And again, this whole concept of chips, which is just becoming heightened, were heightened during the pandemic. Supply chain shortages, I don’t know, Bill, the last time you bought a car, but I actually bought a car during the height of the pandemic and was, Oh my god, it’s such an expensive and, you know, chaotic experience trying to find something because of this global chip shortage. And so a neon, I believe that, you know, you know, over around 50 percent of the world’s neon, I think comes from the Ukraine and two of the largest neon producers in the US. And I forget the name of the other one, but they’re located in Mariupol and in Odessa, respectively. And so Mariupol, as we know, was being completely decimated in the eastern part of Ukraine, and that is going to have significant impacts on the neon market for semiconductors, and neon just exists out in the air. And so you can collect it and purify it through air separation. But I believe that most people do that through, you know, in association with steel production. And so in the United States here, of course, we produce a lot of steel. And so it would be possible for us to also produce neon, but it’s just something that we haven’t been doing. So, yeah, but that’s that’s a major point of concern for people right now. [00:14:25][80.5]

Bill Loveless: [00:14:25] Yeah, it doesn’t take much to stir up more global markets on any commodity. And given a war of this of this magnitude, we can expect that there will be repercussions. [00:14:36][10.4]

Abigail Wulf: [00:14:37] Exactly. And I’m not an economist, but you know, I think everybody heard about the massive spikes in nickel prices again on the London Metals Exchange just last month because of the war in Ukraine and because of Russia’s control over the Class one nickel market, they’ve settled down again, but again, just opening people’s eyes to where are we getting these things from? Where else could we be getting things from that could be better for our supply chains and our security? [00:15:02][25.4]

Bill Loveless: [00:15:03] You know, even before the war, largely because of concerns over reliance on China for production and processing of these materials, the Biden administration had taken steps to grow the critical minerals capability in the United States, including announcing a series of of public private partnerships in February. Do you think the administration is off to a good start on this? On this matter or not, [00:15:29][25.5]

Abigail Wulf: [00:15:30] the administration and Congress have been really taking this issue seriously, and we’re glad that we’re that they’re coming at this from a whole of government approach, but also an entire minerals lifecycle approach. You know, it’s easy politically to focus on one thing versus versus another, you know, like just recycling over also responsible production. But what you’re seeing from this administration in Congress is a seemingly level headed approach to the entire supply chain. We know that recycling is going to play a very important role in, you know, this going forward. But if you look at the reports coming out of the International Energy Agency, if you look at the report coming out of the World Bank, you’re just seeing that demand is far outpacing any kind of supply that we’d be able to provide through recycling alone. So, you know, we’re going to need increased production of these things, which includes responsible mining. We’re going to be need to looking at substitutes. And we’re going to be needing to, you know, investing in a lot of the technological changes to make these things more efficient. You know, back in the day with electric vehicles, they used to just take a battery pack and stick it into an ice vehicle. But today they’re making all sorts of changes, you know, Tesla putting the battery in the body of the vehicle into the chassis on the bottom. And so that kind of efficiency to like reduces the amount of copper in the amount of things that go into these vehicles. But those kinds of advances in efficiency will take time. And so you are going to need some more responsible production. So yes, we had, you know, the EO on supply chains last year, we had the 100 day supply chain reviews. Following that, we had the amazing. Bipartisan infrastructure law, which goes into the entirety of the supply chain from, you know, bumping up funds to the Earth MRI program within the U.S. Geological Survey, which actually does the mapping in the United States to figure out what mineral resources do we actually have? Because remarkably, we actually don’t have a very good understanding of exactly what our geologic deposits are, which make it very difficult to make good, good and better land use planning decisions to do things like never before. Things like $6 billion in this infrastructure bill for four batteries only. And so that’s separated into $3 billion for battery materials processing, which is incredibly important and which I’d love to get into more here in a second. And then another $3 billion for the manufacturing and recycling of of batteries, because this is really sort of the the key piece here. We want to make sure that in this transition in this race for electrification, for the energy future, that we don’t just pigeonhole ourselves here in the United States and among our allies as just being assemblers, you know, like snapping Lego pieces into place. You know, there’s not a lot of high value like innovation expertize or, you know, IP intellectual property that comes with that. You know, we want to make sure that we’re getting this stuff like battery component production like cathode manufacturing, anode manufacturing because those jobs are, you know, they come with more innovation, they come with more expertize, they come with better salaries and all of the things that flow from that innovation and expertize, you know, the the spin off effects of that of that technology. So there are those investments in the infrastructure bill, and we’re very excited to see the administration and Congress taking those steps. [00:18:55][205.2]

Bill Loveless: [00:18:55] Well, the the policymakers in Washington these days are looking, you know, more closely than ever at some of these issues, as you note, and including a commitment by the Biden administration to use the Defense Production Act to enable greater production of these materials in the United States. What is to make sure we understand here? What is the Defense Production Act? We hear a lot about it now. We heard about it during during the pandemic and how might it be used to promote production of critical minerals in the United States? [00:19:26][30.2]

Abigail Wulf: [00:19:26] So the Defense Production Act is really a wartime measure that can be used to sort of send a market signal, but also to ramp up government investments in certain areas for a wartime effort, really. And so it’s just a remarkable signal in and of itself that the Biden administration really sees this need in this urgency to shift to electric vehicles and equating it to essentially a wartime effort. And I think that’s something that here it’s safe. We we definitely concur with. Again, we want to make sure we’re not overly beholden to nations that don’t share our values so that we can make decisions in our country’s best interest. We are already so beholden on the Chinese Communist Party for the majority of these materials. So it will take, we think, a wartime effort and that kind of a market signal to get the trillion dollar investment. Because, you know, our auto industry, which relies on these things, they give us about a trillion dollars to our U.S. economy each year, either directly or indirectly. The U.S. government isn’t going to give, you know, battery makers a trillion dollars to do these things. And the DPA doesn’t do that. You know, I think it’s like something like $750 million that could be appropriated. And of course, Congress could add on to that if they wanted. But it really is just we need to signal to downstream users, to the automakers, to the to the clean energy makers, to the defense producers. Everything that this you need to care where your supply chains are coming from and you should be helping to invest a lot of this capital that they have tied up in securing their supply chains as well. So the DPA, though right now it’s kind of to be seen what’s going to happen when the rubber meets the road. But you know, the administration has talked about feasibility studies for new mining, and I know there are a lot of groups that are very concerned that this means that, you know, there’s going to be cutting of corners and they’re just going to be permitting things left and right. But what the administration is really communicating is that they anything, any new production should be done to the highest standards. You know, both environmentally and socially and, you know, their commitments to responsible mining principles as well, you know, making sure that is there is robust community and tribal engagement, but just letting people know that we need more of these things and we’re going to need them quickly is very valuable. [00:21:43][136.7]

Bill Loveless: [00:21:44] You mentioned the funding as I understand it. One of the prerogatives that’s at the president’s disposal with this law is to offer loans or loan guarantees to companies subject to appropriation by Congress or to make purchases or purchase commitments. And and there’s the option of installing equipment in government or private factories. But from what you’re saying, sounds like there’s not. A lot of money available under this act at the moment, right? [00:22:10][26.2]

Abigail Wulf: [00:22:11] Yeah, I believe there’s around $750 million, which I mean, don’t get me wrong that that’s a chunk of change, I think, to most average Americans. But again, we’re talking about an industry that is at this scale of the entire U.S. economy. You know, so it takes anywhere from a couple hundred million dollars to a billion dollars to build one mineral processing facility from the ground up. So, you know, $750 million from the EPA would maybe cover one then mineral processing facility if a brand new one. So, you know, it’s an excellent signal. I think that, you know, that dollar amount, that funding amount could change again, depending on Congress. I think it also sends a great signal to revitalize the build back better legislation that sort of stalled in Congress. So there are there are a couple different things that could come from this EPA. But I think as long as it is again executed, not by cutting corners, by doing things to the highest standards which we have here in the United States and among allies. And again, yes, on that actually working with allies to trying to make sure that in the short term, you know, we have our neighbors to the North and Canada. We have allies in Australia that have a lot of the supplies of these things. And these are countries that are a part of our national technology industrial base, the type where they’re essentially treated as sort of states in a way where we can source things sort of quickly from these places. So making sure that perhaps this money can go to them as well to make sure that we can get the raw materials responsibly and quickly? [00:23:42][91.1]

Bill Loveless: [00:23:43] Well, I mean, obviously, you applaud the action taken along the lines of the Defense Production Act. But I’ve also read where you’ve cautioned that and I’m quoting you here from some social media you did earlier in the week. While the upstream is important, you say we need to make sure any deeper funding is also used for the arguably more vital midstream minerals processing and battery component production to be truly successful. And you went on to say, if it doesn’t matter where we’re digging stuff up, if it doesn’t feed industries at home and among allies, what did you mean by that? [00:24:16][33.1]

Abigail Wulf: [00:24:16] That is absolutely right, Bill. So exactly what I said. It doesn’t matter where you dig stuff up currently, because China currently controls anywhere from 40, 50 to 90 percent of all minerals processing. And so, as I said in my testimony to the Senate last week, you can’t just dig up a rock and stick it in a Tesla. There are many different steps that have to be done to that rock to break it down, concentrate the metals and then essentially dope the metals with something else to put it into a battery cathode or something like that. And the United States has less than four percent of all minerals processing, and we make zero percent of cathodes and anodes. So, you know, politically speaking, in the United States and around the world, the conversation around critical minerals supply chains always devolves into mine or don’t mine. And I would just say, as I said earlier in our interview, that’s sort of a false question. We know we’re going to need to mine more, but we also know we’re going to need to recycle more, but we will need to mine more. And the real question is, where are we going to send that stuff that we dug up out of the ground? Because right now it’s all going to China, and that is a critical choke point and our supply chains. So while we’re talking about responsible mining practices, we also need to make sure that we’re focused on this processing piece and diversifying that processing piece, not just within the United States, but among our allies as well. Everyone from the European Union to Canada to Australia to Japan, we all have the exact same problem. You know, all of the all of our supply chains for all the critical minerals, they all run through the Chinese Communist Party. And so, you know, we all should be working together right now. We’re all sort of working. There are, you know, partnerships between the United States and Canada, between the United States and the EU. There are conversations that are happening, but, you know, robust action, you know, multilateral funding pipelines, different things that we could be working on together to, you know, setting up trade deals to be facilitating this kind of transfer of knowledge and goods between ourselves. It’s really necessary. [00:26:26][130.0]

Bill Loveless: [00:26:27] You mentioned in your testimony you were among several witnesses before the Senate Energy Committee the other day testifying on this topic. What was your read of that hearing? How did it go? What was your impression of the questions in the in the the concerns of the members of that Senate committee? [00:26:43][16.3]

Abigail Wulf: [00:26:43] I think in any hearing, you know, you’re going to get some degree of political theater, but I really find the Senate Energy and Natural Resources Committee to be one of the most bipartisan and sort of level headed committees out there. There are members on that committee that have been working on this issue for decades, like a very long time senators. You know, Lisa Murkowski, Republican from Alaska, senator. Democrat from Washington State. You know, in previous Congresses have been working on critical minerals legislation for a very long time, and so I think everybody on that committee understands what we need to get done and they understand the urgency of the situation. They’re just, you know, coming at it from a couple of different angles. But for the most part, I thought that hearing was, you know, very productive. I I’m looking forward to the lead to any, you know, new legislation or, you know, there are a couple of bills that were put out by senators on that committee, two that were mentioned. You know, Senator Manchin just put out a bill to increase mine workers in the United States, which was great because the workforce issue was something else. That’s totally a key challenge that we need to help overcome right now in the United States. We have, you know, zero minerals processing degrees essentially in this country, whereas China has like 39 different universities that are putting out student thousands of students with mineral processing degrees every year. And they’re really just a handful of brains in this country that really know those things. So, you know, Colorado School Mines Missouri’s S.A., some of these, these these universities and colleges are training sort of these next generation people, but it’s very difficult to attract that talent. So, you know, commitments from the committee for bills like that and, you know, a number of other bills out of that committee, [00:28:37][113.3]

Bill Loveless: [00:28:37] you know, you speaking of politics, you know this the administration’s interest in using the Defense Production Act in this way, you know, has has drawn broad support even from entities that are normally adversaries like the National Mining Association and the Center for Biological Diversity. Have you been surprised by that? [00:28:56][18.7]

Abigail Wulf: [00:28:57] So I I’m not surprised by the National Mining Association. It was a bit it was a bit shocking for the Center for Biological Diversity. I do believe they walked back that statement a little bit afterward, but I honestly do think that organizations like the Center for Biological Diversity. Any organization that cares about the, you know, the planet’s climate should be heartened, I think, by the EPA and again, by the administration’s commitment to not cut corners and to make sure that any new production or things that they’d like to get done here are done to those highest environmental standards. Again, it sort of remains to be seen how that’s done in practice, but I think that the administration and others are familiar that to get anything done, you’re going to need, you know, the social license to do it. And it’s that focus on the social license that I think it will hopefully come through through the EPA. [00:29:54][57.3]

Bill Loveless: [00:29:55] You know, the U.S. is home to just one active lithium mine. As I understand it, it’s in Nevada. New and potential lithium mining and extracting projects are in various stages of development in states including Maine, North Carolina, California. How do you see the U.S. mining sector shaping up now? [00:30:14][18.7]

Abigail Wulf: [00:30:15] I think that, you know, there are many challenges that face domestic production in the United States, but again, it’s we have this historical legacy of things not being done properly here in the United States. We have over 500000 abandoned mine lands. There’s, you know, legacies of polluting waterways. There’s legacy is of, you know, not communicating well with communities or tribal groups. And these are all problems that we’re that are really coming to bear today. And people are understanding that the practices of before will not be tolerated today or in the future when it comes to mining. And I think that there are, you know, a lot of savvy and good mining companies that understand that as well. So, you know, there you’ll hear it on the left, in the right, many different issues on the right. You know, domestic mining, it’s difficult. We have a very arduous permitting process can take anywhere from seven to 10 years, but it also could take up to two decades, three decades, you know, to to permit a mine, which is certainly we see as a problem. We need transparency so that it’s not just this, you know, hot potato that federal agencies don’t want to be the ones to say yes or no. And so they just keep asking for more and more and more studies. And essentially just like drawing this process permitting process out because they don’t want to be the ones to say yes or no. But simultaneously, again, you need to address a lot of those historical historical. [00:31:50][95.4]

Bill Loveless: [00:31:53] It’s difficult. [00:31:53][0.3]

Abigail Wulf: [00:31:54] Yeah, it’s very difficult. These these the historical pollution, the historical mismanagement and just making sure that there is a way to clean up those mines. There is a way to make sure there’s meaningful community engagement. And there is a way to make sure that the public can fully benefit from any materials that are being extracted from public lands. [00:32:14][20.1]

Bill Loveless: [00:32:15] Yeah, and it seems to me that’s that that’s a problem because there is those concerns. And yet there’s this sense of urgency that we’ve got to get on with it and produce and process more of these materials. But overcoming some of these obstacles and these differences and disagreements is just going to take time, especially with the swings we see in politics in the United States. [00:32:34][18.9]

Abigail Wulf: [00:32:34] Exactly. And geologically speaking, the United States could never do all of this on our own. And so again, it’s it always devolves into minor, don’t mind politically. But again, it’s just, you know, we can’t. We only have like point one percent of nickel reserves in this country. So of course, you know, you’re not going to get all of your nickel from the United States that you’re going to need for your electric vehicles. You’re going to need to work with other countries. Australia has huge nickel deposits to get this stuff from in responsible ways. But, you know, so the conversation around domestic mining, though I think is an important one to have because nimbyism happens everywhere, not just in the United States, but everywhere. And I think that most people would agree that it’s it’s a little hypocritical if we’re just going to say, well, we’re not going to do any of it here. We’re going to benefit from all of this stuff in our tech driven societies. But you know, we’re just going to push this off. It’s somebody else’s problem to deal with their minds being shut down all over the world there. And, you know, I don’t think I’ve got a chance to say this in my testimony, but you know, we’re just because let’s hear it now. Yeah, I know when a point, you know, when it comes to permitting to having deposits in these things, you know, we’re not here to pick winners and losers, but just because you have a deposit doesn’t automatically make you a winner. And so, you know, there are some places that are very special where you know you, you shouldn’t be extracting mineral resources. There might be a higher use to that special place. It could be tourism or agriculture or some other kind of energy production. But you know this this idea that you know, we can only get things from the United States, that’s not true. We need to be working with other countries. And but at the same time, nimbyism exists everywhere. So how can we also make sure that we can get enough of the stuff from here so that we can insulate ourselves from those supply shocks? And I think the the trillion dollar question is how much is enough? You know, do we need three months of lithium supplies to fuel 600000 amount of electric vehicles? So that will have X amount of months of buffer if there is a supply disruption until we can get something else from an ally. You know, it’s and again, for the DPA, I think people are very worried that it’s just going to be the carte blanche like mine, everything. And I think what people want to know is how much do we need? And so it’s it’s that kind of analysis that we’re working on. It’s safe. And you know, the answer is enough and trying to figure out what that enough means is the challenge. [00:35:15][160.9]

Bill Loveless: [00:35:16] It won’t talk about one other material here, and that’s uranium. You know, interestingly, the US government does not consider it a critical mineral. But yet the U.S. nuclear plants rely heavily on imports of uranium from from Russia. What sort of attention is that get issue getting now? [00:35:33][17.2]

Abigail Wulf: [00:35:34] So let’s see if we don’t focus that much on uranium, actually. But yeah, they the the definition of critical mineral changed in the methodology for the U.S. Geological Survey between the first list that got put out in around 2018 in this more updated list, which you know, does not include uranium. And I think that’s all I can say on that, quite honestly. [00:35:57][22.6]

Bill Loveless: [00:35:59] So it’s an interesting it’s an interesting Typekit topic. Yeah. You know, effective communication is an important to the public understanding of complex issues like this and and communication has been a big part of your career, including your work at NASA’s Earth Science Division. You know, there you were a senior science communicator. What’s missing in public understanding of critical minerals today and how do you bridge that gap? [00:36:26][26.9]

Abigail Wulf: [00:36:26] People don’t understand how things are made up, period. I just don’t think people, if you haven’t taken an Earth science course and maybe some of us did, you know in middle school, you know, your sixth grade, seventh grade, eighth grade, earth science class. But you know, maybe you remember plate tectonics or maybe you remember fossils. But just the understanding again of I think people know like the phone example or the computer example, but it’s everything. It’s everything, as I said earlier. Look around you. If it wasn’t grown, it was mined at one point of time from like the feldspar in your mug to the silica in your water glass, everything. So I think that that is a severe disconnect that we have in the public right now. They’re very used to things being instant and automatic and Amazon, like, you know. And somebody once said to me, Well, why can’t you just 3D print the batteries? And I was just like, What do you think the ink is made out of in the 3D printer? Those chemicals? And that’s the other thing people don’t. People in organic chemistry, you know, people don’t understand what rocks are made of. Rocks are made of strings of chemical elements, and it’s breaking down those chemical elements. Geology 101, you know, I think, but I think of a rock like a sentence. You know, a rock is the sentence. The mineral is the word in the sentence. And the letters that make up the word are the chemical elements that make up the mineral. That is, you know, it’s breaking down and extracting those individual letters that you’re trying to do in mineral processing to then stick it into your car. So maybe that’s taking my analogy too far, but that’s how I think about it. [00:38:13][106.7]

Bill Loveless: [00:38:14] And I think that’s that’s a perfect way to end our discussion because you need to break these things down very elemental terms and and and sort of wake up and look around you and see what it is that you’re touching and what it is you’re consuming and what is critical. Abby Wolff, thank you very much for taking the time to join us here on the Columbia Energy Exchange. [00:38:35][21.0]

Abigail Wulf: [00:38:35] Thank you so much, Bill. It’s been a pleasure. [00:38:37][1.2]

Bill Loveless: [00:38:42] Thank you again, Abigail, and thank you for joining us on Columbia Energy Exchange. The show is brought to you by the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs. The show is hosted by Jason Bordoff and Me Bill Loveless. The show is produced by Steven Lacy, Jamie Kaiser and Alexandria. Her from PostScript Audio. Additional support from Tori Lavelle, Kristin Smith, Daniel Prop, Natalie Volk and Kyu Lee. Sean Marquand is our sound engineer. For more information about the podcast or the Center on Global Energy Policy, visit us online at energy policy that Columbia Dot Edu. Or follow us on social media at Columbia. You energy and if you like what you heard, consider giving us a rating on Apple Podcasts. It helps the show reach more listeners like yourself. We’ll see you next week. [00:38:42][0.0]