Bill Loveless/Jason Bordoff [00:00:04] Happy New Year. It’s Bill again. We’re almost ready to get back to our regular programing, bringing you a new show next week. But today we have another conversation from 2020 to our co-host Jason Bordoff’s interview with Mafalda Duarte from September. How Richer Nations Help Finance Clean Energy and climate projects in the Global South has been a popular topic since the close out of COP 27 In Egypt, Barbados Prime Minister Mia Mottley has been a leading voice in this conversation. Her recently proposed Bridgetown agenda offers a new way of financing climate projects in developing countries, which includes efforts to transition away from fossil fuels. But these projects come with their own set of financial policy and technical challenges. Mafalda is the CEO of Climate Investment Funds, one of the most ambitious efforts to finance clean energy projects in developing and middle income countries since 2015. She’s led efforts all over the world to help countries build climate resilient economies by innovating ways to mobilize capital. Jason and Mafalda discuss the barriers to mobilizing capital for clean energy projects in the developing world and how to overcome them. Please enjoy Mafalda Duarte. Thank you for joining us on Columbia Energy Exchange. Great to have you here in New York City at Columbia University and here at the Center on Global Energy Policy. Welcome.

Mafalda Duarte [00:01:35] Thank you, Jason. It’s quite a pleasure to be here and and be in this part of Manhattan and remembering my times at Columbia University walking these same streets. So it’s been great.

Jason Bordoff [00:01:51] Well, does it look the same? Different, but same as what you remember?

Mafalda Duarte [00:01:57] It’s you know, it’s a lot of the same memories. The buildings are more or less the same. The certainly the building that I lived in. It’s exactly the same. And, you know, there are some changes in terms of cafes and restaurants, but the feel is pretty much the same.

Jason Bordoff [00:02:13] Well, give me give the listeners a sense of from that point to now your path and then we’ll talk about what you’re doing now. But you’ve lived in something like 30 developing countries. Just tell people about your background and how you came to do the work that you’re doing now.

Mafalda Duarte [00:02:32] So, I mean, I started off in development. It’s all that I have done throughout my career. But at some point, you know, when I lived in Africa and I started to see the impacts, climatic impacts. So I was in Mozambique when they had the really large floods back in 2000. And, you know, and I witnessed over the years quite a few of the impacts of of climate events. I then decided, okay, I need to understand a little bit more about the science of of climate and also the economics of it. And so that’s when I decided to come to Columbia and do precisely that. So do do a little bit of the economics of sustainable development and climate change and do some of the science. So oceanography and climatology and for my own opinion on the matters and you know, how how important I thought climate was going to be from a development point of view. And that’s what I have been doing since. So Columbia was actually quite pivotal moments in my career because it redirected me to climate work.

Jason Bordoff [00:03:46] Why is climate an important development issue?

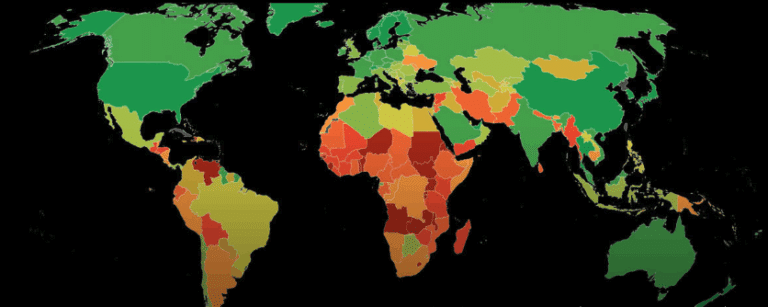

Mafalda Duarte [00:03:49] Because I mean, and we are seeing it right now, if we actually don’t tackle the the the the threats and if we if we don’t prevent the impacts of climate, you are already seeing erosion of development gains. And we will see more of that erosion of development gains. You know, and there are several studies talking about that, you know, what the potential impacts might be on agriculture yields. We are already observing significant GDP impacts and and impacting the lives of people when climate disasters hit in these economies. I mean, even in small island developing states, it wipes out large, large portions of GDP. One event can wipe out large, large portions of GDP. So there’s just so many ways in which climate manifests itself and can can basically retract us from development gains and and prevent the achievements actually of the SDGs.

Jason Bordoff [00:05:00] And I presume dealing with those risks requires money. And that takes us to what you’ve been doing for, what, seven, eight years, something like that. Leading the Climate Investment Fund, one of the largest multilateral funds for climate work in developing countries, for those who aren’t familiar with it, tell people listening what what the Climate Investment Fund is and what it is working on as a decarbonizing. Expanding energy access is that adaptation and resilience in the country, in these countries, all of these things.

Mafalda Duarte [00:05:30] So this the climate investment funds was is an interesting initiative by the G8. So G8 back in 2008 and decided to set up these funds. And let’s remember that 2008 was a time of financial crisis, was also a time for those following the climate negotiations 2008 2009. Where things weren’t going so well. So G-8 decided to set up these funds and put public capital on that could take on risks, reduce the costs of of technologies, of investments, cost of capital, and basically with that, provide the incentives to governments and to the private sector to actually make different investment decisions in developing countries. And I you know, I always like to take people back to that point in time because I think hopefully gives a message of hope to those maybe getting a little bit skeptical or concerned whether we can actually do things now at the scale and speed that is needed. And so I like to take people back because, you know, what I say is if it was possible in that context of a financial crisis and, you know, where there was hardly any investments in renewable energy, you know, some of the investments that we have been supporting in sustainable land management, sustainable forestry, coastal zone management, agriculture, you know, energy, these were investments that there was no track record, there was no such investments that had been done or had happened in a lot of these countries. And the governments and the private sector investors came in and, you know, with with our capital, with other partners, the multilateral development banks, their capabilities, technical and financial capabilities and other partners, we have made considerable progress.

Jason Bordoff [00:07:42] And how do you how do you measure progress?

Mafalda Duarte [00:07:44] You know, when we talk about some of the metrics that we put out ourselves in terms of our impact, we we talk about, for example, supporting 26.5 gigawatts of renewable energy installed capacity. And this might not sound a lot because, you know, when you think about how much we need to actually do to respond to the energy transition and the climate goals. But this is the caveat, is that this 26.5 gigawatts were investments in technologies in in markets where there hadn’t been these investments, where we hadn’t seen geothermal investments, where we hadn’t seen concentrated solar power investments, where we hadn’t seen solar PV investments or wind investments. So that was the context. So when we we talk about these 26.5 gigawatt. That’s the context that we have to put those numbers in and that we try to put those numbers in. And again, as I said, you know, hopefully this gives a message of hope that, you know, if it was possible under those difficult conditions. I mean, right now we are in extreme difficult conditions as well. But even before the pandemic and the war in Ukraine, you know, giving that message of hope that, you know, actually in different investment decisions can be made with the right type of capital and partnerships.

Jason Bordoff [00:09:14] And the projects like the one you were talking about, a target for renewable energy. In many parts of the world, renewable energy is the cheapest form of energy. So why do we need your fund at all? Why isn’t the private sector doing this?

Mafalda Duarte [00:09:26] So right now, you’re right. But at that point in time and for many years it wasn’t. And that was the case for our capital to be in. And this is the reason why right now, when we marked our ten year anniversary and we were thinking, okay, what what is it now that we should be focusing on? We launched two investment programs last year, which are about coal transition and are about renewable energy integration. So we are pivoting from supporting renewable energy power generation into those other areas, which we believe require our type of capital and our type of partnerships.

Jason Bordoff [00:10:10] I was surprised you agreed with me as much as you did. I thought you were going to say there are still a huge number of barriers to private capital investing in clean energy projects like currency risk and political risk. And I mean, we need a lot of capital. There’s a lot of private capital out there. A lot of it’s going into clean energy. But there are real barriers to investing in developing and emerging economies now.

Mafalda Duarte [00:10:31] There are there are there are various I mean, it’s very country specific. So different barriers in different countries. Right now, we have you know, we have the added complexities of countries, developing countries in fiscal. Distress or, you know, we have doubling the doubling of number of countries, developing countries in risk of high risk of that distress already at that distress. You know, you have seen during this war now in Ukraine, the downgrades, the sovereign downgrades, credit rating downgrades for so many more so many of these countries. You know, in fact, an interesting data point after the first 200 days of the war in Ukraine, because you were talking as well about currency risk, we saw 142 developing countries that had their currencies had depreciated by an average of 2.8% against the dollar. So these are risks that exist. And and this is why we are also seeing a lot more risk versus from from private sector and private investors to do to go in into these markets and invest in clean energy. So I’m not I’m not saying that, you know, there aren’t the risks there. There are risks that need to be tackled and and probably, you know, in the years to come in the in the short term, there might also be a role for capital like ours because of this risk. But, you know, from a broader perspective, what we assess from a broader strategic perspective was we think there are areas that are not receiving sufficient attention.

Jason Bordoff [00:12:36] That’s what you’re talking about with coal and renewable integration. So I’m going to come to that in a minute. But let me just finish on this question of I’m been part of during Climate Week and UNGA this week in New York, as I’m sure you have, you know, and in years and years before that, you know, countless conversations with a title, something like mobilizing capital to scale clean energy in emerging and developing economies. What’s the answer? What are the handful of key action items that you think governments de-emphasize? Maybe the private sector? I mean, what what if you if you were to answer that question, how do we mobilize that capital? What’s the answer to these questions?

Mafalda Duarte [00:13:20] Yes. I mean, I think there’s because the ways through which private capital come to these investments are also different. So and we have also, you know, engaged with private capital and support private capital in different ways. One of the ways is actually see what is preventing domestic financial institutions to provide that to these investments. And, you know, it might be we’ve have the experience and maybe we have to work with these financial institutions so that they understand the business opportunities, so that they understand how they are going to assess, you know, credit assess these these their clients when they are providing debt for specific projects and investments. It might be that, you know, they there’s a need for providing them with concessional capital so that they can pass on that concessional ity to pull in the demand for the capital. And we have done that and we have done that for renewable energy and for energy efficiency investments and we have done that in middle income countries and we have done that in low income countries as well. Then you have, you know, you have a private capital, you know, investors that are are basically in markets where there’s IPOs, where IPOs are allowed that they would like to be part be part of IP rounds and and bid and and invest in some of these technologies and projects. So for those I mean then we are talking about what are the risks what what are the risks that they are facing in those countries? Do we need to provide them you know, do we need to provide them with some guarantees? Do we need to provide them with some concessional capital as well? But, you know, it’s very country specific. We have the flexibility to come in and and assess what are the major risks, how can our capital be used to tackle on those risks that are being faced directly by the investors or by the financiers, by the financial sector in the country? And how this one, I respond to that. But we also work with governments and, you know, try to work with governments and have them enhance their legislation or regulations to facilitate private sector investments.

Jason Bordoff [00:16:19] What’s a good success story in that vein? Like who’s doing that right?

Mafalda Duarte [00:16:24] We work, for example, with Kazakhstan and in Kazakhstan. We we not only finance some of the first types, renewable energy, IPPs, but also worked with government to make enhancements in their renewable energy law and then worked with government to simplify all of the processes and the regulations and the permitting and the licensing to enable those investments from from private sector. So we can do that as well, because, you know, our partners, the the the partners that we have to channel our capital through are the multilateral development banks. And as you know, they they have this capability of working both at the transaction level, at the project level, but also at the policy level. So we do both we we we have supported both. And, you know, we are we of course, as you know, you know this better than probably myself and others. There has been quite a and an important progress in terms of doing business for renewable energy in the countries. And we have a lot more countries with targets on renewable energy and with enhanced regulations doesn’t mean that there is no way to go. There’s still some way to go. And sometimes, you know, the devil is in these smaller pieces of regulation. People like to sometimes quote a law and there’s this target. And, you know, so like the big strategic macro issues and and when you start to then getting into the details of, you know, how do we actually get investments on the ground, what are the different pieces of regulation, You start to then see other constraints that need to be tackled as well.

Jason Bordoff [00:18:32] How does this energy crisis we’re in, the middle of which I think Europe gets most of the attention I just interviewed. European Commission, head of the Green Deal, Frans Timmermans, here on campus. But this is having ripple effects in emerging and developing economies all over the world, which can’t afford almost anything oil, gas, coal, not to mention the shutdown of much of the fertilizer production in Europe because natural gas prices are so high, which will impact food prices in the months to come, years to come. Is that causing people to say, look how volatile these global hydrocarbon markets are and let’s move faster to get away from hydrocarbons or just or a sense of and I’ve heard it this week, I’m sure you have to a sense of some resentment, some hypocrisy that if Europe’s going to go and build LNG terminals and invest in hydrocarbons, maybe developing in emerging economies should be doing more of that themselves.

Mafalda Duarte [00:19:26] I mean, this is a really important question. I think it’s really important. And this has been, you know, one of my objectives and goals in engaging in different conversations this week here in New York is. Making people understand what’s actually happening in developing countries. So we were already coming from a pandemic where, you know, developed countries had had had the capability, the fiscal capability, to really inject a lot of resources into their economies. I’ve seen some numbers, 16% of GDP. Those numbers are nowhere near that in developing countries. So we we were and and we basically understood the all of the implications of the pandemic. It hit developing countries harder than than developed countries. Now, war in Ukraine came and just significantly aggravated this. So now we have this. Increase in energy prices. In food prices. 50% increase in energy prices from last year. 21% increase in food prices. Four from last.

Jason Bordoff [00:20:56] Year. In where?

Mafalda Duarte [00:20:58] These are. These are. These are global. But it hits developing countries disproportionately because their energy bills are like. Much higher as a percentage of GDP than developed countries. I mean, developed countries on average 2 to 5% in some developing countries is 25%. And so this is this is the reality. And as I was saying earlier on, the macroeconomic conditions are extremely difficult because countries the level of debt that developing countries are now facing. The difficulties that they are, which gets compounded. So they having to to incur a lot more debt because they are getting into capital markets, they have to pay more for borrowing because of all of the downgrades that we have seen. There is interest rate spikes. There’s the the downgrade of their credit risk. There’s depreciation of currencies. This is putting a lot of pressure on their reserves. So fiscally, the countries are in a really difficult situation. This makes the climate discussions and certainly COP 27 extremely challenging because developing countries are seeing that the climate discourse, the narrative over the last few years has been one of moving everybody moving away from from fossil fuels, including them. And now they are seeing, because of the war in Ukraine, that developed countries are actually coming back to fossil fuels. So that that certainly makes it really, really challenging from a from a from a climate perspective. And to be honest, you know, because of the increased demand, for example, on for for for gas supplies from Europe, which are being diverted from some developing countries, that is putting pressure on price, of course.

Jason Bordoff [00:23:26] And on substitutes like coal prices, which are near record levels.

Mafalda Duarte [00:23:30] All of it is on record levels oil, gas, coal and some of these economies that are being impacted by this diversion of supplies, they are they are suffering. You know, this is real. This is real impact because these are economies that are extremely reliant on gas supplies. And so this is an extremely challenging time. And I know that, you know, a lot of the conversation is whatever. And in Europe and in Europe, a lot of the conversation is whatever we do, we are not going to lock ourselves into capital investments whose economic life is 30, 40 years, because that’s not consistent with the climate goals. And hopefully that is the case. You know, it’s it’s this question which you have debated yourself in several of your podcasts, which is, you know, the short versus medium term. We are seeing narratives around saying we have to invest in greenfield fossil fuels significantly. This is a significant risk.

Jason Bordoff [00:24:46] And it’s probably I mean, it’s complicated for so many reasons, but it’s you know, you focus on how do I want to come to what you’re doing to integrate renewable energy into the grid and to retire coal. That’s that’s the that’s power. That’s electricity. There are obviously a lot of other energy needs and emerging. I mean, all economies emerging in developing economies, too, for heavy industry to mechanize, agriculture, to build cities of steel and cement of millions of people, mobility transport, which, you know, is not yet electrified and probably some. You tell me if that’s right, some challenge and different types of challenges. Thinking about transport, electrification in some poorer countries in the world. So how do you think about and and different different considerations like, you know, gas might be rather than dirty cooking fuel. It’s it’s it’s the substitutes you’re talking about might be different at the same time. You know, I was reading in the Financial Times today the head of the European Investment Bank saying, no, we’re not We can’t finance natural gas projects in developing economies. How do you think about that difficult, controversial question of kind of the role of gas and in the outlook for the energy needs of emerging and developing economies?

Mafalda Duarte [00:25:57] You see, I like to I like to simplify this this this issue and take us back to the science of climate. I mean, if we really internalize the science and and fortunately, the more we have the scientists come out and we have articles all the time, you know, they keep doing their measurements and they keep monitoring and coming out with new data. Every time the updates indicate that things are moving faster than we anticipated before. And so I think this is what’s important. We have to anchor these conversations and maybe, you know, anchor this in some analysis. What does it mean to make significant greenfield investments in fossil fuel? Because this is the issues that we are locking in capital that will be there for decades to come. And this is why the transition debate right now is so difficult for for for developing countries, because you you have quite a lot of coal fired power plants that have been built in the last couple of decades. They have still economic clout. I mean, one of the interesting data points that I saw at some point was 60% of this fleet in developing countries is less than 20 years old.

Jason Bordoff [00:27:32] Yeah.

Mafalda Duarte [00:27:33] So there’s still 20 years or more of economic life in these assets. And now we are having to have the discussion, you know, if we want to have these assets retire earlier. Mm hmm. How much do we have to pay? Do we want to have this conversation for new gas, you know, investments in five, ten years? So I think, you know, so this is how I think about this. And and, you know, hopefully this pandemic and the war in in Ukraine right now, if there’s one thing it should do is make people understand how connected we are, the connectedness and the fact that, you know, crises call for unprecedented action. And actually. Both private sector and governments can take very bold action. And can do things that hadn’t been imagined before. That’s the sort of thinking and mentality and mindset that is needed here because people I think it’s important that people understand. Look at the science pandemic. The pandemic is nothing compared to what can happen with climate impacts if we cross tipping points. Because after crossing some tipping points and this comes from the science after crossing some tipping points, it’s not a one episode that you then might try to recover within the next decade or within the next 5 to 10 years. You cross tipping points. It’s the succession of events that keep unfolding and keep impacting the economies and societies on a regular basis.

Jason Bordoff [00:29:28] Yeah, I think I mean, you’re raising a really interesting and important issue I’ve thought about and struggled with. I mean, I think we all have, which is how you’re pointing to the fact that the carbon budget is just math. It is what it is. There’s only so much CO2 you can emit consistent with, you know, these temperature targets. And the idea that the nearer to medium term reality is such that one might say, well, investment in hydrocarbon infrastructure is justified, but it can’t operate to the end of its normal economic life. And so one. So what do you do? So one option is to say we have to respond to a crisis, as you said, with just a totally different mindset which and just scale things so much faster and clean energy. Not to mention that beyond electricity, there are still some parts of the economy we’re not even ready to necessarily do that with. And my and that’s that’s what we should be doing. And and my fear is that, well, that’s not going to happen. So we’re just going to build more infrastructure without a plan to strand it, without a plan to retire. Or maybe we actually should think about how do we invest in things with an intentional plan to strand them, that we want them to be stranded the day we build them. What would that look like? Tell me what you’re doing. Well, you referenced all of the existing infrastructure that is already built that we hope in a sense will be stranded, meaning coal plants that would not operate for 40 years, that, you know, average 13, 14, 15 years, depending on where you are in some Asian countries in particular. So that’s a big priority for what you’re doing at the Climate Investment Fund. How how should we approach that? What does it look like to have a managed strategy for retiring some of the most carbon intensive infrastructure?

Mafalda Duarte [00:31:13] The simple answer is it’s complicated and it’s country specific. So we are working right now in South Africa, Indonesia, India and well, in Philippines. We actually had quite a significant interest. We had 14 countries that approached us for support through our program. But you know, with the capital that we have, we currently have around 2 billion U.S. dollars. So we will focus on these first four countries. It is country specific. So, you know, keeping it at a more higher level. We need to help countries decommission, repurpose these coal fired power plants. We need to help enable massive build up of renewable energy capacity. And we need to deal with the transmission infrastructure and all of the other investments that are necessary to enable the integration and the management of this intermittent renewable energy capacity into these power systems. So these are core elements of what we are doing in these countries, or we will be investing and financing and. And then the two other pillars of what we are doing is working with governments to see which work is necessary at the policy and the regulatory level. But also, you know, in terms of institutional capacity, you know, to to manage such a transition, to think about such a transition. What does it mean? What are the policies and, you know, what are the plans that or how do we bring this transition into strategies and plans in different sectors and how do we then deliver on that transition? And then the other pillar, which is to me central. We haven’t yet spoken about it, is what people talk about is just transition is is the people and the communities. And unless too, you know, in our view and we have been doing quite a bit of work on on just transition and massive just transitions camps and become central in this energy transition, it’s going to be very difficult to see how we will succeed. So just transition needs to be at the core, at the heart of the energy transition agenda in the countries. So we will be looking at what are the economic diversification opportunities in these communities in this region.

Jason Bordoff [00:34:06] Because people will if you if you shut down existing coal fleet, some will lose their jobs in plants and mining and supports important parts of the economy in some places.

Mafalda Duarte [00:34:18] And this is the other thing, you know, sometimes people say, well, if you look at the numbers, you know, these workers, they don’t represent much in the labor force of a country. It’s a small percentage. In any case, these are people. These are lives, and all lives matter. And but when you actually zoom in into the you know, to the communities in the regions, it’s a different picture altogether because it’s not just the direct jobs that they can be and they can be 10% of the labor force of of that region. It can go to 30% of the labor force with indirect jobs. But there are all other sorts of implications. It’s the revenues that the coal companies and the coal mines generate to local authorities. It’s and it’s that those companies, they actually invest themselves in social projects, in those communities, which are important social projects to health, education. They invest, they make investments. But you even have you know, you even have other circumstances. We did this study in Jharkhand in India, and we saw a very interesting connection with the railways, India, where basically, you know, they get 40% of their revenue from transporting coal and then they turn around and subsidize passenger fares for more than 50%. Let’s just think about it. How many millions of people in India use Indian Railways and how many poor people use Indian railways and how important that transport is actually in their livelihoods, in their lives. So this is complex. And and, you know, there are countries that have gone through this before. I mean, UK, Germany is going through it there. There has been some experience in the U.S. There’s more documented experience from developed countries in developing countries. This is what.

Jason Bordoff [00:36:32] We’ve seen in Germany. You know, their target was pretty far out into the future and they put tens of billions of euros into the program, which the countries you’re talking about probably can’t do.

Mafalda Duarte [00:36:42] And that’s what comes back to our discussion earlier on on the the fiscal constraints of these countries. So this is everything is sort of like comes together because if we actually don’t have the resources to do this work and support these communities, we are going to see lack of support. The energy transition agenda. So everything becomes interconnected. And this is why, you know, we keep messaging and saying don’t let us not pay lip service to just transition. Let us actually make it central in this in this I in this in these these conversations, in these investments and actually put the resources on the table to make this happen. You know, it’s going to be really challenging. And you see, I see a risk which is we might be able to go a lot faster on the infrastructure side than we might be able to go on the social side. And what’s the impact of that? You know, because the decommissioning, repurposing of coal fired power plants. You know, I’m not a technical specialist in the area, but you know what? What I have been seeing, because we are also going to be investing in those types of projects. It takes a few years. I mean, changing, redirecting the economy and livelihoods of people in communities doesn’t take two years, three years or four years. So the more we can do in all of these countries to really, you know, do all of the analytical work that is necessary, that is missing, do all of the consultations that are necessary to bring people together in a serious, you know, in in a serious, inclusive, empowering process and and come up with, you know, concrete actions and and measures that can be financed. And we will be learning along the way. And that’s what we have to do.

Jason Bordoff [00:39:04] What about not the technical or social part of retiring coal plants, but just the economic part? I mean, have they paid back their investors? Who are the investors of these private firms? The role of state owned enterprises is that make it easier or harder when you have that kind of sovereign involvement in the investments?

Mafalda Duarte [00:39:24] I mean, it’s again, very country specific. You have you have countries where the coal fleet is basically owned by a state owned company. But you have other countries where the fleet is owned both by state owned companies and private sector companies. We haven’t yet come to the point of and I won’t be able to tell you at this point, maybe in another conversation in six months time or nine months time. What are those valuations? What is it that you know would have to be paid that makes sense to pay to to support early retirement of these assets if they are if they are going to be basically retired or decommissioned. In other countries, we are not looking at how much we have to pay to or, you know, how how much we would have to pay into home to retire those assets earlier. What we are doing is let’s try to take as much advantage of the assets that are in place. And so that those are that’s a different conversation.

Jason Bordoff [00:40:42] So as you said, it’s it’s country specific. So just, you know, briefly, because we have a little bit of time left, but to give people a sense of one country and many people with this idea of focusing on existing coal infrastructure point to the just energy transition partnership and what was done with South Africa. So just to help listeners understand that and is that a model for other countries? You know, the role of Eskom in South Africa is somewhat unique relative to maybe some of the other countries you’re talking about.

Mafalda Duarte [00:41:08] I mean, I think I’m probably more than many. I’m optimistic about these what they’re being called as jetpacks or these country platforms. And I actually see value in these partnerships. It is the first time and this is, you know, this is a very personal view. This is the first time we are seeing a government and and a group of developed countries come together and agree politically that they are partners on a journey of support. You know, so in this case, supporting South Africa, transition away from coal, the matrix, the energy matrix, South Sudan Africa is predominantly call that partnership at political level, which will hopefully last for the years to come and not be subject to changes in in governments. Which then translates into other mechanisms in-country and other mechanisms of collaboration between the government and and external partners. Pretty much the idea is how do we bring different financiers together, pool, capital pool, different types of capital, And with this drive, the the multiple sides of this agenda. So South Africa is is you know, is a case where. There’s a need to retire coal fired power plants or decommission and repurpose. You know, part of that fleet, which is which is old. It’s a case where there’s ample opportunities to invest in renewable energy capacity. And there are private sector investors interested in investing. And, you know, and where there’s massive investments needed in transmission infrastructure, this type of partnership, I see the benefit of it because, again, this is a bit towards the climate investment funds. What we’ve been trying to do since our inception. You know what we did? We were set up with the mandate of bringing the multilateral development banks together for our first and foremost, bring their balance sheets to bear together for specific purposes in their technical capability, and with that bring other private sector capital and other bilaterals and others into the same investment programs. So you are basically pooling capital and technical support towards the same vision and the same goals. And what is being tried to do now in South Africa and the other countries is the same at a larger scale and with more investors and with more financiers. And the thing is that, as you know, you know, we have we have now foundations that are interested in playing a role which, you know, in this area which weren’t there, you know, before. In other areas, we have private capital wanting to come in and invest. So I think, you know, this this these platforms and they will you know, they will look differently in different countries. But I think what matters is the vision, retaining that vision of bringing the key financiers together, working closely with governments and saying, okay, here. What needs to happen on the policy front. So no private sector saying here’s what we need from you. Government to to make business easier. And basically, you know, the different financiers bringing their different types of capital. And, you know, we come in and can take more risks than others. And that’s where we will place ourselves. That’s where we have placed ourselves in the past. But with the intent of enabling ideas is not just putting the risk capital for the sake of putting a risk. Capital is putting risk capital for the sake of enabling those others who can’t take those risks into their balance sheets. So that’s basically I mean, of course, the jet in South Africa, I’m I’m just describing a little bit the electricity component side. South Africa has included two other areas in in in their just energy transition partnership. And you will see the investment plan is going to come out before the cop. Most likely they have a green hydrogen component and electrification of vehicles component because they they you know, their vision is there’s a need to invest in these other areas that can drive new industries and can drive significant job creation.

Jason Bordoff [00:46:37] Are the you mentioned, you know, pooling capital of the multilateral development banks. Are they mobilizing capital and capacity commensurate to the scale of the challenge? And if not, how does that change?

Mafalda Duarte [00:46:51] We are actually enablers of the multilateral development banks, and it says it has always been the case since we were established. We we were there, as I said, to take on risks that they are not well prepared to take according to the, you know, the decisions that their boards have been making. And so this is what we are doing as well. We are bringing in capital to the table and taking on risks and bringing capital at terms that the MDB is themselves can provide. And with that and locking their own balance sheets, is there a need to do more? There’s a need to do more from all of us.

Jason Bordoff [00:47:43] And so in that in that spirit, I guess we’ll just conclude. I’m curious to ask you, what sort of next for the Climate Investment Fund has the uptake of ambition, the alignment around net zero 20 51.5 has? How has that impacted the strategy and what are the areas of focus for the Climate Investment Fund moving forward?

Mafalda Duarte [00:48:02] So we will continue to focus. I mean, we just launched these two new investment areas, coal transition and renewable energy integration. We launched one new area in June, nature based solutions. We will launch an industrial decarbonization investment program at the coming COP, and we intend to launch also an investment program on climate smart cities. And we will be making sure then in terms of what we invest in the future, we move away from this polarization of the climate agenda on mitigation and adaptation. We are saying very clearly that what we need is deliberation in investments, in maximizing both outcomes, mitigation and resilience outcomes. We. Have been able to mobilize over the last year more than $2 billion. It’s it’s not a lot of a lot of capital. When one things with thinks about what needs to happen and the volumes of risk capital that we actually need if we are to unlock the trillions that are necessary for sustainable infrastructure in developing countries. But so I do think that there is a need for more ambition in putting this type of capital at at the different scale and levels available to to facilitate these investments. But, you know, we will be delivering with what we have right now. And it’s always our hope that demonstrate a demonstration, in fact, is actually pretty important when you start demonstrating, because right now all of these questions about how do we go about core transition in these countries? How do we go about just transition in these countries? Well, we have to do it. You know, we just have to roll our sleeves and do it and demonstrate, you know, what works and what doesn’t work. We have people prepared to understand that certain things will not work. Other things will work. We have to learn from those and and move on and scaled those experiences. So that’s what, you know, we set ourselves to do and that’s what we will do.

Jason Bordoff [00:50:26] I thought it was a simple cookie cutter silver bullet to deploy. And it turns out this is complicated and hard. So thank you for explaining that. And it’s there’s a lot of work for all of us to do and obviously is a huge priority for the work we’re doing here at Columbia, with the work we’re doing on scaling clean energy in emerging and developing economies and giving access, not just access, but the amount of energy people need for meaningful levels of prosperity. And. And those are big numbers. And when you try to reconcile them with the carbon budget you were talking about. So thanks for making time during your visit to New York to come visit your old stomping grounds here at Columbia and visiting us here at the center. And thanks for the work you’re doing every day.

Mafalda Duarte [00:51:13] Thank you, Jason. It’s been a pleasure.

Jason Bordoff [00:51:15] Thank you.

Mafalda Duarte [00:51:16] Thank you.

Jason Bordoff [00:51:21] My father. Thank you again. And thanks to all of you, our listeners, for joining us on this episode of Columbia Energy Exchange. The show is brought to you by the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs. The show is hosted by me, Jason Bordoff, and by Bill Loveless. The show is produced by Stephen Lacey, Cecily Mazer Martinez, and Aaron Hartig from Postscript Media. Additional support from Daniel Prop, Natalie Volk and Kyu Lee. Sean Marquand engineered the show. For more information about the podcast or the Center on Global Energy Policy, visit us online at Energy Policy Columbia about EDU or follow us on social media at Columbia U. Energy. Thanks again for listening. We’ll see you next week.