This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

In Australia, workers at the Chevron-operated Gorgon and Wheatstone liquefied natural gas (LNG) plants and at the three offshore producing platforms feeding the North West Shelf terminal, operated by Woodside, announced earlier this week that they were preparing to pursue industrial action.[1] Markets reacted nervously to the news and European benchmark month-ahead TTF (Title Transfer Facility) prices jumped by 28 percent on the day after the announcement.[2] The labor unions’ demands include higher pay and restrictions on the outsourcing of jobs to contractors.[3] This move by the Australian unions opens the possibility of indefinite strikes with a seven-day notice, potentially disrupting more than half of the output from the world’s second-largest LNG exporter in the weeks ahead. In this Q&A, the authors analyze the potential impact of strikes on LNG supply and their implications for global markets and energy security.

How much volume is at risk?

A similar labor dispute at Shell’s Prelude floating LNG terminal last year took 76 days to resolve,[4] which raises the specter of a prolonged LNG capacity outage if the strikes proceed. A substantial volume is at risk. The combined LNG export capacity of the Gorgon, Wheatstone, and North West Shelf projects is 40.8 million tons per annum (mtpa),[5] which is equivalent to more than 55 billion cubic meters (bcm). This is more than 2.7 times the capacity that was disrupted during the outage at the Freeport LNG terminal between June 2022 and February 2023, one of the most significant unplanned events with far-reaching impact on global LNG supply in recent years.

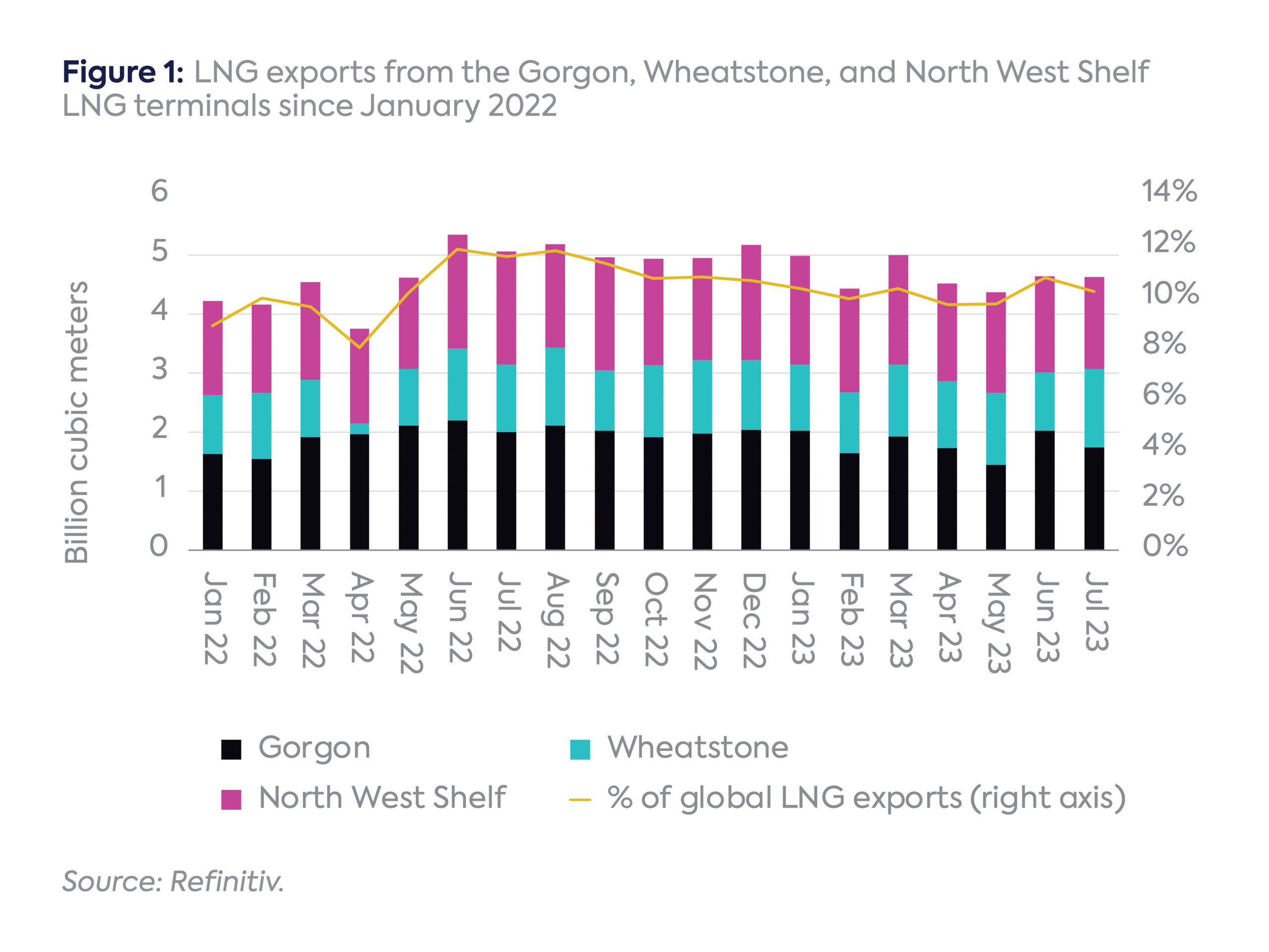

At more than 57 bcm, the combined LNG output from the three plants facing potential strikes was slightly above nameplate capacity over the past 12 months and represented 10.5 percent of global LNG exports during the same period (Figure 1). As a comparison, Russian pipeline gas supplies dropped by around 80 bcm in 2022 from 2021 levels. The steepest year-on-year declines in Russian pipeline gas flows to Europe occurred between August and December 2022 and averaged between 8 to 9 bcm per month. The three Australian plants risk losing 4 to 5 million bcm of production per month if they go offline.

Which LNG importers are most impacted?

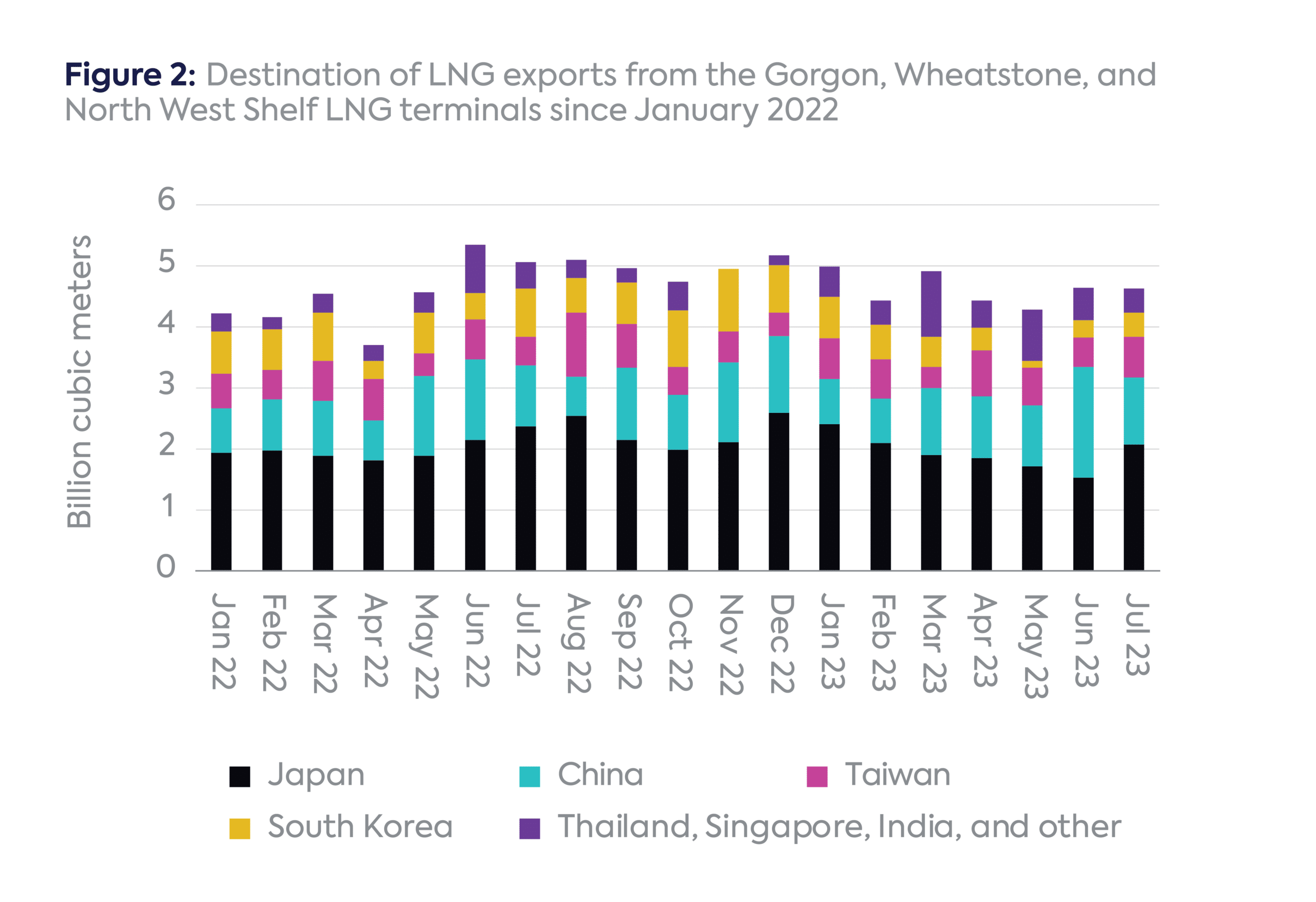

Australia is Asia’s baseload LNG supplier, with virtually all of its LNG exports staying in Asia. Japan remains the largest buyer of Australian LNG (accounting for about 40 percent of total sales in 2022), followed by China, South Korea, Taiwan, and a host of other importers across South and Southeast Asia.[6] Among major LNG suppliers to Asia, Australia obtains the highest prices, as most of its LNG is sold under long-term contracts. The smaller buyers, namely Korea and Taiwan, pay the highest prices for Australian LNG on average, followed by Japan, China, and India.[7] From the three Australian plants at risk of strike action, approximately 44 percent was exported to Japan, 22 percent to China, 13 percent to Taiwan, and 12 percent to South Korea over the past 12 months, with the remainder flowing to Thailand (5 percent), Singapore (3 percent), India (1 percent), and other destinations (1 percent) (Figure 2).

What will be the market impact?

Even though Asian and European spot prices have come down and European gas storage levels currently look healthy, softer market conditions are no reason for complacency.[8] A major LNG supply disruption—as well as cold weather, a further reduction in Russian pipeline supply to Europe, and a Chinese LNG demand recovery—are key factors that could increase market tensions and price volatility.

The market impact, including the return of higher prices and reconfiguration of global gas flows, will largely depend on the duration of the disruption, assuming the industrial action proceeds. Gas demand in Europe and Northeast Asia is currently lower during summer, but significantly higher volumes are consumed in the fourth and first quarters. While Asian countries would be the most affected, the market impact would be truly global. The scope for a supply response is very limited: little or no upside can be expected from other LNG suppliers or from alternative pipeline gas suppliers to Europe and only very limited additional volumes are likely available from pipeline gas suppliers to Asia.[9] Consequently, European and impacted Asian buyers would have to compete even more for the existing pool of spot LNG supply. If the strike persists, the loss of Australian LNG will require higher flows from the United States to Asia. Notably, since the sharp reduction of Russian pipeline gas deliveries in 2022, US LNG has predominantly been flowing to Europe to fill the substantial supply gap on the continent. Qatar, also a large supplier to Asia and Europe, tends not to shift its sales based on short-term pricing opportunities.

Most of the response would have to come from the demand side. In Europe, that likely means a continuation of the current demand response and solidarity policies, including gas and power demand savings, and fuel switching in the power and industrial sectors. Coal-fired generation in Europe has dropped by 47 terawatt-hours (TWh) during the first 6 months of 2023 (equivalent to around 9 bcm of gas demand). Energy saving policies may also have to be implemented in Japan, Taiwan, and Korea—as was done by Japan over the previous winter.[10] These importers would have to consider higher utilization of coal-fired plants, and possibly even ramping up oil-fired generation. Japan has recently restarted its 11th nuclear reactor and would be incentivized to keep the current operating fleet online as much as possible.[11]

The largest unknown is China, a significant importer of Australian LNG. In 2022, China provided significant relief to the global gas market by reducing its LNG imports by around 20 bcm. Unlike other markets, China may have some supply flexibility to respond to a significant Australian outage. It could maximize domestic gas production, and potentially secure additional (albeit limited) imports from Turkmenistan or Russia. But China also has more contracted LNG in 2023 than in 2022 (+12 bcm), and might be less keen to divert its newly secured LNG volumes to neighbors, even if it could mobilize additional supplies from elsewhere.

Finally, Southeast Asian countries, which had been priced out from acquiring spot LNG in much of 2022 and early 2023, might find themselves in the same situation once again.

What are the implications for global energy security?

Recent incidents—the outages at US Freeport LNG, the potential strikes at Australian LNG facilities, and multiple supply disruptions caused by hurricanes on the US Gulf Coast in recent years—highlight a vulnerability. LNG supply from “friendly” Western democracies can also be unreliable, albeit for different reasons than gas supply from Russia. The US and Australia now represent around 40 percent of total LNG supply.

Policy decisions in these two countries can also have an impact on global LNG supply security. Australia’s Domestic Gas Security Mechanism,[12] and a recent decision that requires new gas fields supplying existing LNG plants to be at net-zero emissions,[13] have raised serious concerns from Japan and Korea over Australia’s reliability as an LNG supplier. Similarly, high US gas prices last summer have re-ignited a discussion on potential US LNG exports curbs.[14] More than ever, LNG importing countries need to be prepared for all kinds of black swan events impacting their energy supply, and not just those originating in unpredictable autocracies like Russia.

Photograph courtesy Chevron Australia Pty Ltd.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

Notes

[1] David Marin Guzman, “LNG Exports at Risk as Woodside and Chevron Strikes Loom,” Financial Review, August 9, 2023, https://www.afr.com/work-and-careers/workplace/lng-exports-at-risk-as-woodside-and-chevron-strikes-loom-20230809-p5dv3n.

[2] Elena Mazneva and Anna Shiryaevskaya, “European Gas Jumps Most Since March 2022 on LNG Strike Vote,” Bloomberg, August 9, 2023, https://www.bloomberg.com/news/articles/2023-08-09/european-gas-extends-gains-as-eon-warns-crisis-not-over-yet?sref=uFaJcogC.

[3] Matthew Fox, “Natural Gas Prices are Soaring as Energy Workers in Australia look Poised to Strike, Threatening Global Supply,” Markets Insider, August 9, 2023, https://markets.businessinsider.com/news/commodities/natural-gas-prices-soar-energy-workers-australia-threaten-strike-chevron-2023-8.

[4] Rick Wilkinson, “Union strike at Shell’s Prelude vessel ends,” Oil & Gas Journal, August 24, 2022, https://www.ogj.com/pipelines-transportation/lng/article/14281759/union-strike-at-shells-prelude-vessel-ends.

[5] GIIGNL, “GIIGNL Annual Report 2023,” July 2023, https://giignl.org/wp-content/uploads/2023/07/GIIGNL-2023-Annual-Report-July20.pdf.

[6] Based on Refinitiv.

[7] https://dimensionspira.spglobal.com/landing-page

[8] International Energy Agency, “Global Gas Security Review 2023,” July 18, 2023, https://www.iea.org/reports/global-gas-security-review-2023.

[9] Akos Losz and Tatiana Mitrova, “Central Asia’s Overlooked Energy Crisis: What It Means for the Global Gas Market,” Center on Global Energy Policy, March 28, 2023, https://www.energypolicy.columbia.edu/central-asias-overlooked-energy-crisis-what-it-means-for-the-global-gas-market/.

[10] “Japan to Request Energy Saving Measures in Winter amid Crunch Concerns,” Japan Times, September 15, 2022, https://www.japantimes.co.jp/news/2022/09/15/business/economy-business/japan-energy-request-winter/.

[11] David Dalton, “Japan / 11 Reactors In Operation As Kansai Announces Takahama-1 Restart,” Independent Nuclear News Agency, July 31, 2023, https://www.nucnet.org/news/11-reactors-in-operation-as-kansai-announces-restart-of-takahama-1-7-1-2023.

[12] Xunpeng Shi and Edward Sung, “Australia’s Natural Gas Security Policy Spills over the Region,” East Asia Forum, July 20, 2023, https://www.eastasiaforum.org/2023/07/20/australias-natural-gas-security-policy-spills-over-the-region/.

[13] Michael Smith, “Australia no Longer Japan’s ‘most Trusted’ LNG Supplier,” Financial Review, July 5, 2023, https://www.afr.com/world/asia/australia-no-longer-japan-s-most-trusted-lng-supplier-20230704-p5dlpu.

[14] Jarrett Renshaw and Trevor Hunnicutt, “Exclusive: White House Rules out Ban on Natural Gas Exports this Winter,” Reuters, October 4, 2022, https://www.reuters.com/business/energy/exclusive-white-house-rules-out-ban-natural-gas-exports-this-winter-2022-10-04/.