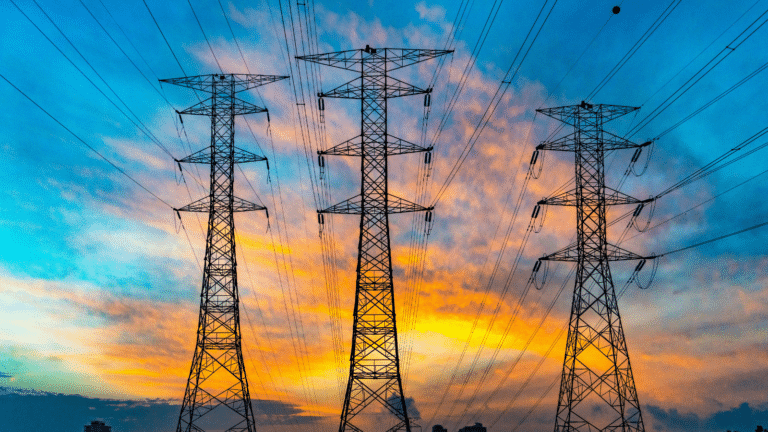

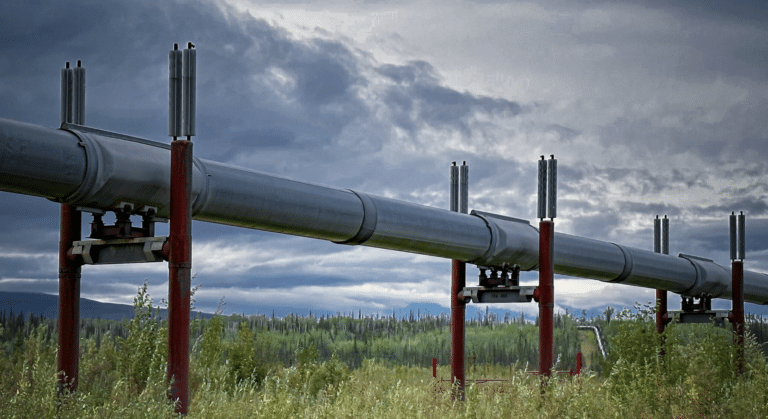

U.S. Natural Gas Insulated as Global Markets Roiled by Conflict

Discover the impact of global conflicts on U.S. natural gas markets, including record-setting spot prices and supply disruptions. Stay informed with insights on LNG capacity, production levels, and international market dynamics.