Could a strategic lithium reserve kickstart US supply chain development?

NEW YORK -- A strategic lithium reserve is being mooted as a solution to stabilize volatile prices that have hindered American mining projects, allowi

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author(s). It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision.

Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available here. Rare cases of sponsored projects are clearly indicated.

President Donald Trump’s first official foreign policy trip, as in his first term, was to Saudi Arabia earlier this month, with additional stops in Qatar and the United Arab Emirates. A series of investment announcements followed from companies and Gulf governments, including for the export of US semi-conductor chips and co-investments in new data centers in the US and the Gulf states. As hosts, Saudi Arabia, the UAE, and Qatar emphasized their bilateral relationships with the United States and their eagerness to secure access to artificial intelligence and defense technologies. They also expressed interest in securing stakes in US energy infrastructure assets, relying on their national energy companies and sovereign wealth funds to deploy capital in the US and at home to massively expand their portfolios of energy assets (especially in liquified natural gas [LNG]), grow domestic electricity generation capacity, and incubate the ecosystem for supercomputing.

This Q&A explores some key financial commitments made by the Gulf states and compares them to other sources of US investment. It explores why the domestic energy and power sectors of these states make them in some ways ideal for technology innovation in artificial intelligence. And it poses the question of why, in geopolitical terms, the Gulf states are positioning themselves as points of connection between US technology, global finance, and growing markets and as a central node in US-China competition. The answers will shape not just the future of artificial intelligence innovation but broader geopolitical and economic dynamics.

In a move away from the Biden administration’s policy on technology diffusion, the Trump administration’s announcements on AI partnerships and data centers in the Gulf seem to allow for greater technology transfer and the creation of new state-owned Gulf firms that will become national champions of supercomputing. Some of the announcements, as summarized by the White House, include:

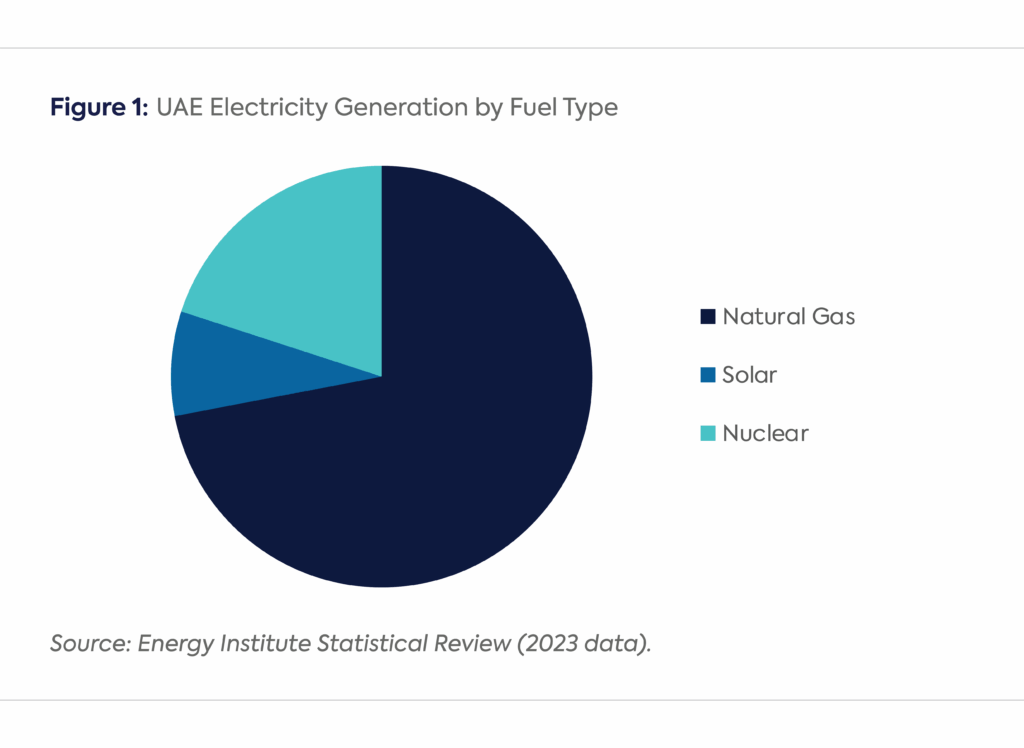

Electricity is a critical element in both the partnership and the planned 5 GW campus. The UAE has a domestic electricity generation mix that is divided among gas-fired power generation, nuclear power generation from four reactors at the Barakah facility outside of Abu Dhabi, and solar power (see Figure 1). Electricity generation from natural gas dominates the UAE energy mix at 72 percent, and is set to grow. ADNOC Gas recently projected gas demand growth domestically at 6 percent per year to 2030. Demand from the new UAE-US AI Campus is estimated at 5 GW, equivalent to an additional 1 billion cubic feet per day (bcf/d) of gas supply, or 10 percent of the 10 bcf/d currently supplied by ADNOC Gas.

The ability to increase power supply across multiple fuels and renewable sources, and to quickly site and construct power plants, is a key advantage for supercomputing power in the UAE. ADNOC’s expansion in gas production and ability to meet domestic demand growth could place the UAE at an advantage to regional and global competitors in the AI space.

Companies have recently announced plans to invest over $2 trillion in the United States over multiple years (implying a $500 billion increase in annual investment), with foreign governments pledging an additional $4.2 trillion. The actual impact on foreign direct investment in the United States could be more limited, as the announced pledges are not binding, and company strategy can change.

More importantly, several of the larger company-level announcements would mean major increases in those companies’ annual capex and R&D, relative to current levels. Apple has promised to invest $500 billion in the United States over the next four years, while it spent under $10.0 billion on capex and $31.4 billion on R&D globally in 2024. Nvidia has similarly promised to invest $500 billion, or $125 billion per year, despite spending only $3.0 billion on capex and $12.9 billion on R&D last year.

Some of these announcements relate to previously planned expenditure and new projects already underway. US technology companies are making pledges to expand their operations in the US, with the simultaneous plans to expand globally, including these co-investments in the Gulf. The future of high tech will depend on capital infusions from Gulf sovereign investors and the political ability to operate across global markets. These announcements could indicate a Gulf and Trump administration magnifying effect, and at the least signify an ambition that could be difficult to achieve.

On the government commitments, Saudi Arabia announced plans for a $20 billion investment in AI data centers and energy infrastructure in the United States, and Qatar’s announcement included $8.5 billion of investment in American critical energy infrastructure and $1 billion in quantum technologies. In addition, both Saudi Arabia’s and Qatar’s announcements included defense purchases: $142 billion by Saudi Arabia and $96 billion in aircraft purchases by Qatar.

Gulf sovereign investment in the United States is largely concentrated in the US energy sector, especially in US natural gas and LNG. Analysis from MEES indicates that an early mover into the US gas sector, Qatar Energy, is now being met with increasing interest from the new UAE fund XRG, ADNOC, and Saudi Aramco, all increasing their equity stakes and positions in US LNG terminals. For example, in the last month, Aramco has indicated plans to increase its offtake agreements and equity stakes in three separate US LNG projects: Sempra Port Arthur Phase 2, Louisiana LNG, and Next Decade: Rio Grande Train 4. ADNOC and XRG will also invest in the Next Decade: Rio Grande project.

Proposed new investments from Japan are $1 trillion, with current investment at around $783 billion, largely in US portfolio assets (US debt and equities). Japan is committing to new investment, but its existing holdings and foreign direct investment far outweigh what current Gulf states invest in the US. Yet there is less acknowledgement or bilateral pageantry over those ties. For example, UAE foreign direct investment in the US in 2023 was roughly $35 billion; Saudi Arabia’s foreign direct investment in the US in 2023 amounted to about $9.5 billion. In foreign assets in the US, Saudi Arabia and the UAE hold approximately $375 billion and $321 billion, respectively, largely in portfolio investments, according to proprietary research by Haver Analytics. Japan has been a consistent and longer-term investor in the United States, and its increased commitments are in line with a modest expansion. In comparison, the jump in Gulf state investments proposed would mark a major increase in annualized investments, given allocations of the last few years.

There is little expectation that a close investment relationship between the Gulf states and the United States, including access to US energy infrastructure and US technology in semi-conductor chips and high tech firms, means that the Gulf states will diminish their trade and investment ties with China. The Gulf states have demonstrated how central they are as mega institutional investors, able to intervene and invest in US technology when it needs to grow, without facing the historical restrictions on US technology exports.

While the US may have some ability to mandate how US chips are used in Gulf data centers, the sector as a whole is not segregating from China. Instead, Saudi Arabia and the UAE have integrated themselves into a global AI race in which both the United States and China will need to keep them close because the Gulf states and their sovereign investment vehicles and firms are well-positioned to deploy these technologies and the energy to power them across a wide geography of emerging market economies. Gulf countries can do this because of their wealth as sovereign investors; their massive domestic energy supplies and ability to ramp up domestic power generation; and their national energy firms that are able to integrate into global infrastructure growth, such as they have with US LNG.

As the host of COP30, Brazil has an unprecedented platform to demonstrate its climate leadership.

The Trump administration is increasingly using equity investments as a tool of industrial policy to support domestic critical minerals supply chains.

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

Gulf Cooperation Council (GCC) countries have not only the world's lowest costs for oil and gas production but also the lowest costs for electricity generated from renewable energy sources.

President Donald Trump’s impulsive, go-it-alone approach is uniquely ill-suited to the long-term and cross-cutting nature of the challenge that China poses.

The global clean energy economy today looks starkly different than it did even 10 years ago. Not only have production and deployment of clean energy technologies expanded significantly, the geographic distribution of clean energy manufacturers, resellers, and end-users has shifted dramatically.

Throughout much of the modern era, limiting or disrupting the flow of energy was a highly effective tool of global power.