This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

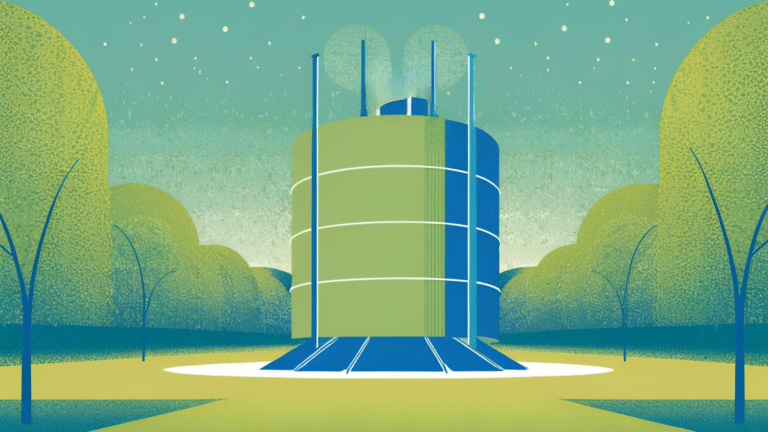

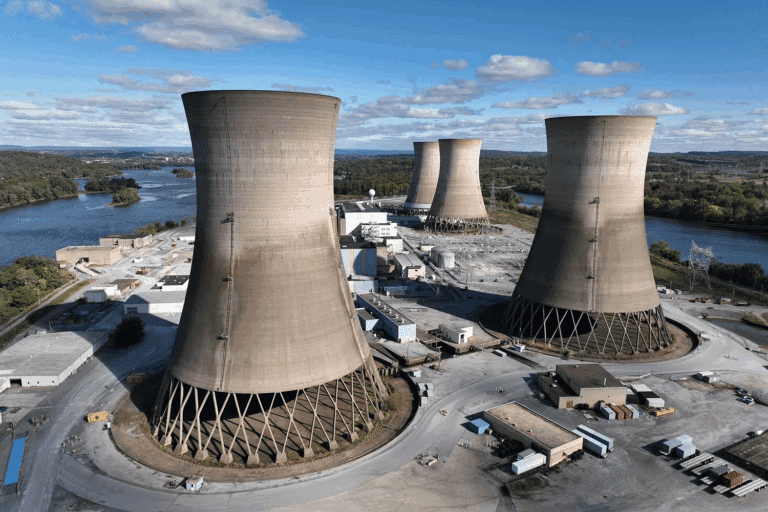

United States civil nuclear diplomacy is back on the move. Last month, the Export–Import Bank of the United States (EXIM) and the Development Finance Corporation (DFC) announced financing of up to $3 billion and $1 billion, respectively, to deploy US small modular reactors (SMRs) in Poland.[1] SMRs—smaller, more uniform designs intended to be factory-manufactured to lower nuclear energy costs—have benefited from congressional support and interagency interest in the Biden administration. This follows the Trump administration’s reversal of a legacy prohibition on DFC funding of US nuclear energy exports.

Domestic market stagnation (only two new reactors have connected to the US power grid this century) requires US nuclear companies to explore the growing export market. According to the International Energy Agency, achieving global climate goals may require nearly doubling the amount of electricity produced from nuclear reactors between 2020 and 2050.[2] A foray into Poland could help to unlock the Eastern European market in a sustainable, strategic fashion. Accelerating progress will be pivotal to US competitiveness in the global market and the trajectory toward net zero emissions in 2050.

Russia has dominated the nuclear energy marketplace, but its invasion of Ukraine has damaged its diplomatic standing and widened the opportunity for US companies. However, the window will not remain open indefinitely, and progress will hinge upon US agencies arranging financing packages that turn diplomatic handshakes into cement in the ground in Poland and elsewhere.

The Polish Opportunity

With EXIM Bank and DFC having just signed letters of intent to support the deployment of the GE-Hitachi BWRX-300 SMR with Orlen Synthos Green Energy as the most recent example,[3] Poland has been the epicenter of the revival of US commercial nuclear diplomacy.

The 2020 US-Poland Intergovernmental Agreement (IGA) on nuclear energy cooperation[4] was a political commitment, and in 2021 the US Trade and Development Agency funded a front-end engineering (FEED) study for potential deployment of a AP1000 nuclear power plant.[5] These developments likely facilitated Poland’s selection of the Westinghouse AP1000 for large reactor builds in 2022.[6]

Separately, Poland-headquartered mining company KGHM announced a plan in 2023 to deploy modular reactors designed by the US company NuScale Power, and in April submitted an application to the Polish Ministry of Climate and Environment to build NuScale SMRs in Poland.[7]

Successfully deploying both large-scale reactors and SMRs in Poland could accelerate progress throughout a region (Romania, Slovakia, Estonia, Czech Republic, and Ukraine) that has coal plants in need of retirement by mid-century to meet decarbonization goals. Poland’s neighbors have, in some cases, handshake agreements to adopt US nuclear technologies. For example, at the 2021 United Nations Climate Change Conference in Glasgow, US special presidential envoy for climate John Kerry and Romanian president Klaus Iohannis jointly announced Romania’s intention to build NuScale SMRs. A May 2023 announcement at the G7 Leaders’ Summit included support for the Romanian SMR project of up to $275 million from the United States, Japan, Republic of Korea, and United Arab Emirates, as well as Letters of Interest issued by EXIM and DFC for potential support of up to $3 billion and $1 billion for project deployment – similar to potential package for Poland.[8] US diplomatic efforts also contributed to the Czech Republic at least excluding Russian and Chinese companies from a tender to build a new reactor that will entail roughly $6.6 billion of investment into the country.[9]

Financing the Deal

For all of the announcements, there are no done deals just yet. Part of Russia’s competitive edge in the past has stemmed from the ability of Rosatom, its state-owned enterprise, to offer a “one-stop shop” including favorable financing terms that private sector companies cannot match alone.[10] The United States will ultimately have to grapple with this challenge if it expects to be competitive in international markets.

To date, the US playbook in Poland has consisted of an IGA demonstrating US political commitment and an intent to finance; funding for FEED work from USTDA; and now, letters of intent from EXIM Bank and DFC. The process has been improvised and tactical, but it could be replicated elsewhere as part of a long-term, sustainable approach. The missing piece at the end—US government financing agencies’ ability to quickly finalize deals—could make the difference, especially as the United States competes with Russia and China for reactor supply deals.

The US may be able to improve the efficiency and terms of its reactor export financing offers to other countries through measures such as:

- Considering improvements in staffing and interagency coordination at the DFC. DFC loan officers face the difficult task of evaluating technology risk across myriad sectors, including nuclear. Some SMRs carry little technology risk; for example, NuScale’s light water-based design has already been certified by the US Nuclear Regulatory Commission (NRC). Expertise to evaluate technology risk also exists elsewhere, for example in the Office of Nuclear Energy at the United States Department of Energy (DOE). Increasing staffing and relying on interagency coordination to evaluate these designs will help the DFC evaluate potential clean energy projects more efficiently.

- Exploring DFC equity scoring. Potential customer countries are eager for DFC equity investment in nuclear deals, but according to federal budget rules, the DFC must score its equity investments entirely as a loss with no expectation of returns—essentially as a grant.[11] This may be discouraging the DFC from exercising its ability to make equity investments, especially in capital-intensive nuclear projects.

- Evaluating EXIM Bank’s processes. EXIM Bank is subject to a statutory 2 percent default rate cap, which requires the bank to virtually freeze lending if exceeded.[12] Senior EXIM Bank officials have identified the cap as an impediment to pursuing slightly riskier projects—specifically to compete with China. This cap leads the US EXIM Bank to act more conservatively compared to competing OECD export credit agencies.[13] In addition, if the bank is authorized to forego expensive, staff-intensive, and duplicative technical analysis for nuclear reactor designs that the NRC has already certified, that could simplify technical analysis.

- Enlisting the DOE Loan Programs Office (LPO). The DOE LPO, with new funding and leadership under the Biden administration, has become an influential player in government energy financing.[14] The LPO now has a vast catalog of loan applications that give it insight into which technologies are most cost competitive, carry the least risk, and have potential to be commercialized and exported quickly. This is an opportunity to closely coordinate domestic manufacturing projects that can serve global markets through exports and meet the energy needs of US partners and allies—with a focus on nuclear energy.

Separate from financing aspects, reactor deployments in the United States would help with subsequent deployments elsewhere by reducing first-of-a-kind construction risks and increasing customer country confidence given the status of the US Nuclear Regulatory Commission as the gold standard of nuclear safety. If countries across Europe are going to step away from Russian reactor supply for energy security as they pursue net zero goals, they will need alternatives. The case of Poland may provide lessons learned to help the United States succeed elsewhere.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

Notes

[1] Monika Scislowska, “US Ready to Lend Poland $4 Billion for Nuclear Energy Plan,” AP News, April 17, 2023, https://apnews.com/article/nuclear-energy-us-poland-221e7fcbe13bba60bd872929a9c822aa.

[2] International Energy Agency, Net Zero by 2050: A Roadmap for the Global Energy Sector, May 2021. https://www.iea.org/reports/net-zero-by-2050.

[3] “Polish Small Reactors Project May Get Up to $4 bln ln in U.S. Financing,” Reuters, April 17, 2023, https://www.reuters.com/business/sustainable-business/polish-small-reactors-project-may-get-up-4-bln-us-financing-2023-04-17/

[4] US Embassy & Consulate in Poland, “IGA Fact Sheet,” October 19, 2020, https://pl.usembassy.gov/iga_fact_sheet/.

[5] USTDA, “USTDA Advances Poland’s Civil Nuclear Energy Program by Funding U.S. Industry-Led Study,” June 30, 2021. Feed studies determine technical requirements and are a critical step preceding a final investment decision. https://ustda.gov/ustda-advances-polands-civil-nuclear-energy-program-by-funding-u-s-industry-led-study/.

[6] US Embassy & Consulate in Poland, “Fact Sheet: United States and Poland Announce Deepening Collaboration on Energy Security and Nuclear Energy,” November 2, 2022, https://pl.usembassy.gov/fact_sheet_westinghouse/.

[7] KGHM, “KGHM Has Submitted an Application for a Fundamental Decision for a Project to Build a Small Modular Nuclear Power Plant in Poland,” press release, April 14, 2023, https://media.kghm.com/en/news-and-press-releases/kghm-has-submitted-an-application-for-a-fundamental-decision-for-a-project-to-build-a-small-modular-nuclear-power-plant-in-poland

[8] U.S. Department of State, “The United States and Multinational Public-Private Partners Look to Provide Up to $275 Million to Advance the Romania Small Modular Reactor Project; United States Issues Letters of Interest for Up To $4 Billion in Project Financing,” press release, May 20, 2023, https://www.state.gov/the-united-states-and-multinational-public-private-partners-look-to-provide-up-to-275-million-to-advance-the-romania-small-modular-reactor-project-united-states-issues-letters-of-interest-for-up-to/

[9] Karel Janicek, “Czech Republic Opens Tender for New Nuclear Reactor,” AP News, March 17, 2022, https://apnews.com/article/russia-ukraine-business-europe-china-czech-republic-e530cea3935d7fab54055f8e63bca655.

[10] Matt Bowen and Alec Apostoaei, “Comparing Government Financing of Reactor Exports: Considerations for US Policy Makers,” Center on Global Energy Policy, August 25, 2022, https://www.energypolicy.columbia.edu/publications/comparing-government-financing-reactor-exports-considerations-us-policy-makers/.

[11] Scott Morris, “Current Budget Rules Stand in the Way of a Reasonable Path for US DFC to Realize Ambition on Climate and Pandemic Response,” Center for Global Development, April 19, 2021, https://www.cgdev.org/blog/current-budget-rules-stand-way-reasonable-path-us-dfc-realize-ambition-climate-and-pandemic.

[12] Congressional Research Service, “Export-Import Bank of the United States (Ex-Im Bank),” updated March 8, 2022, https://crsreports.congress.gov/product/pdf/IF/IF10017.

[13] EXIM Bank, “Fiscal Year 2022 Major Management Challenges,” Office of Inspector General, September 30, 2022, https://img.exim.gov/s3fs-public/oig/reports/EXIM%20Major%20Management%20Challenges%20FY%202022%20OIG-O-22-01.pdf.

[14] Congressional Research Service, “Inflation Reduction Act of 2022 (IRA): Department of Energy Loan Guarantee

Programs,” August 5, 2022, https://crsreports.congress.gov/product/pdf/IN/IN11984.