This report represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated. For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Annual Circle.

-

CGEP’s Visionary Annual Circle

-

(This list is updated periodically)

Air Products

Anonymous

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Executive Summary

In recent years, many of the world’s biggest corporations, including Google, Facebook, Microsoft, and Apple, have pledged to power their businesses with increasing amounts of renewable energy in order to reduce their carbon footprints and contribute to efforts to address climate change. Such efforts have had an encouraging impact on US power sector decarbonization, with a material and increasing share of US wind and solar deployments now driven by the procurement preferences of corporate customers. The vast majority of corporate procurement of renewable energy has been secured via power purchase agreements (PPAs).

Going forward, a wider universe of companies is expected to look to such PPA agreements as a means of contributing to a low-carbon future, raising the question of how substantial these initiatives might be in supporting the overall transition to zero-carbon electricity. Indeed, a number of positive underlying trends are likely to facilitate continued growth in the corporate renewables PPA market. For example, electricity demand in the technology sector continues to grow rapidly, while renewables PPA penetration in the commercial and industrial sectors more broadly remains low, with room to grow. Additionally, expectations of continued declines in the costs of solar and wind technologies are likely to facilitate more procurement. Lastly, US companies are facing increased pressure from customers, employees, and institutional investors to improve their greenhouse gas emissions profiles.

At the same time, certain factors may constrain the size of the PPA market, such as market regulations that limit the feasibility of PPAs in certain regions and the need for renewable PPA prices to be competitive relative to wholesale power prices. Scale and creditworthiness requirements can also limit the universe of potential corporate buyers, and the financial risks brought about when signing long-term contracts may further deter some market participants. Finally, companies increasingly have alternative emission reduction mechanisms at their disposal, such as renewables energy credits (RECs), carbon offsets, and green tariff programs.

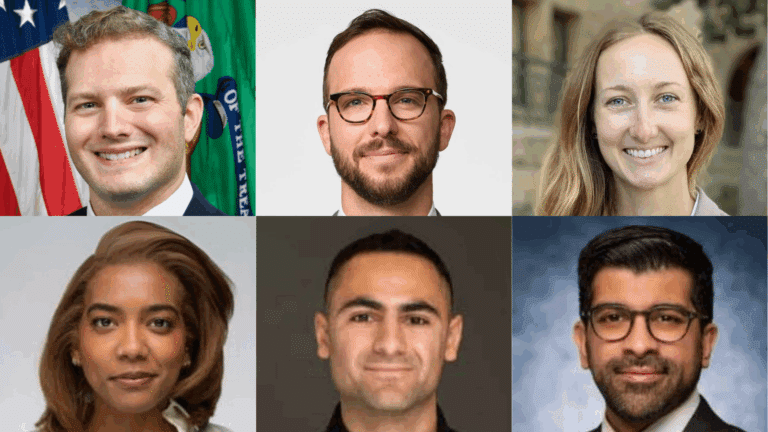

This student-led paper, from the Power Sector and Renewables Research Initiative at Columbia University’s Center on Global Energy Policy, explores the drivers influencing the renewables PPA market and assesses whether these procurement initiatives by nonutility corporations are likely to continue growing in the United States at a rapid enough pace to support power sector deep decarbonization goals. The analysis finds that while robust private sector participation in recent years has been encouraging, the potential market size going forward may be smaller than previously projected, highlighting the need for comprehensive policy frameworks to support power sector decarbonization.

More specifically, the findings are as follows:

- Under current policy conditions, the corporate renewables PPA market could drive between 218 and 296 TWh of demand equating to 55–85 GW of incremental solar and wind capacity additions in the United States through 2030 across three scenarios. While this range implies significant growth, the base case scenario suggesting additions of around 70 GW is below other projections and implies that recent procurement rates could slow.

- These results, showing a wide range of potential outcomes and the possibility that PPAs may not drive as much renewable capacity additions as has been projected by other organizations, highlight the risk in overreliance on private sector actors to voluntarily address unpriced greenhouse gas externalities. While renewables costs have fallen dramatically in recent years and the actions of many large US corporations have led to significant additions of zero-carbon generation resources, the market may not be deep enough to sustain its recent pace of annual procurements without further policy incentives.

- More comprehensive policy frameworks are needed if US policy makers wish to achieve the rapid growth in renewable electricity that is needed to support broader decarbonization of the nation’s economy.[1] Effectively designed decarbonization policies could drive greater growth from traditional sources of renewable energy demand (e.g., utilities) while also making emissions reduction initiatives a more straightforward business decision for corporations. These could include federal carbon pricing, clean electricity standards, increased research and development (R&D) spending, green infrastructure investment, and the extension of federal tax credits. Initiatives to expand zero-carbon targets, corporate green tariff offerings, and firm REC values at the state and regional level could also accelerate renewable adoption.

- The US corporate PPA market has been impacted by the COVID-19 pandemic, with some projects facing supply chain disruptions, financing bottlenecks, and higher offer prices. As a result, 2020 renewables PPA transactions tracked below 2019 levels. It remains to be seen whether the pandemic will have any long-term impacts on corporate procurement initiatives.