Trump delayed a global carbon tax. Now he wants to finish the fight.

American officials are drafting a diplomatic cable that warns dozens of countries against adopting a climate fee on the shipping industry.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Commentary by Matt Bowen & Kat Guanio • July 06, 2023

This commentary represents the research and views of the authors. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated.

The European Union agreed in July 2022 to a notable inclusion in its list of what constitutes “environmentally sustainable” economic activities: nuclear power. The published list, which aims to help companies and investors make sustainable investment decisions,[1] recognized that the technology will play a part in the energy transition to a low-carbon economy in Europe. Shortly after the EU decision, Ontario Power Generation in Canada issued a green bond that included nuclear energy in its use of proceeds, and demand reportedly exceeded the deal size by almost six times.[2]

These recent decisions to include nuclear energy in financing taxonomies meant to assist in mitigating climate change are consistent with the technology’s presence in the energy mix in most models of net-zero scenarios. For example, the International Energy Agency (IEA) included a near doubling of nuclear power capacity by mid-century in its updated roadmap for net zero emissions by 2050.[3] At the first-ever nuclear-themed pavilion at a United Nations Climate Change Conference, at the Sharm el-Sheikh Conference of Parties (COP27) in November 2022, IEA executive director Dr. Fatih Birol made the case that nuclear power was making a comeback.[4] At the same time, though, he lamented that the international financial community had so far failed to provide a level playing field for nuclear energy to help tackle global development and environmental challenges.

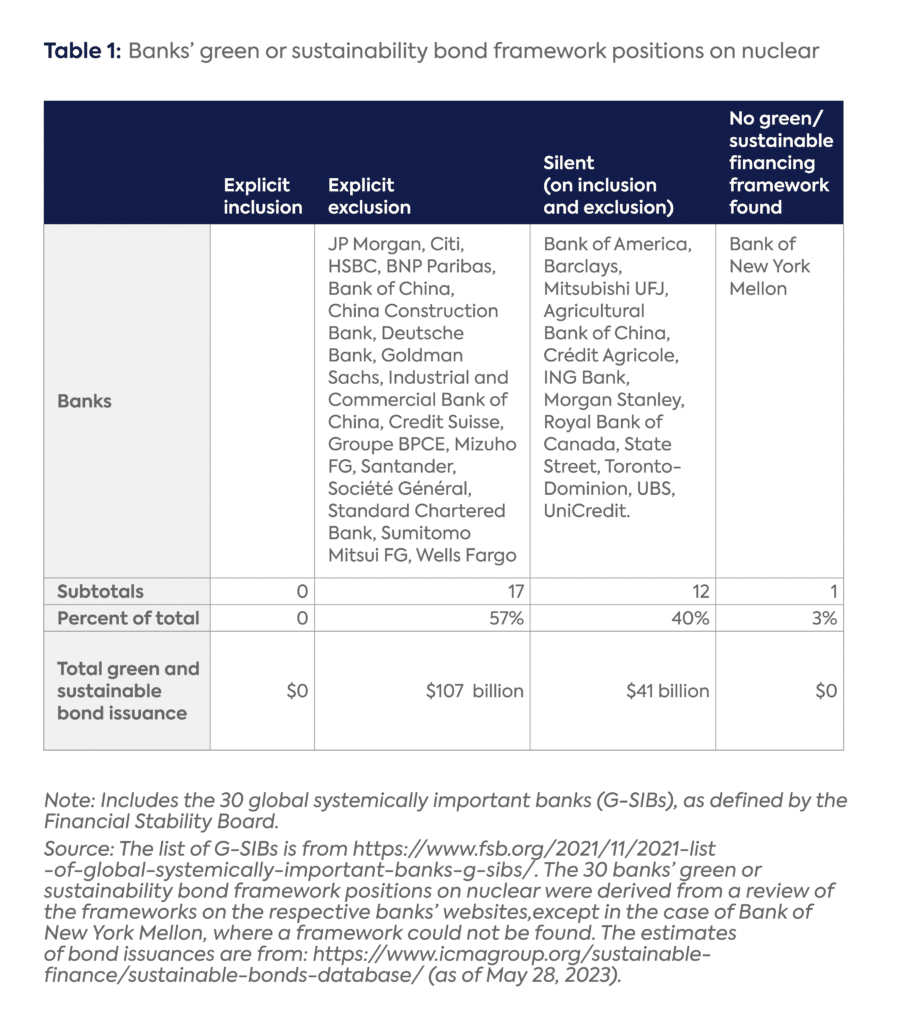

Despite nuclear energy’s anticipated role in achieving decarbonization, the EU decision is a bit of an outlier: many climate finance taxonomies either explicitly exclude nuclear power or are ambiguous on whether it is included. The authors reviewed green and sustainable bond frameworks of the 30 global systemically important banks and, as they later highlight, found that none explicitly includes nuclear energy in their sustainable finance taxonomies. This commentary will touch on the role that nuclear energy typically plays in decarbonization modeling, explain what climate finance taxonomies are meant to do, and highlight the general disconnect between the two.

As noted by the United Nations at COP27,[5] the world is not headed toward a low-emission future, and appears more likely to be veering into a potential climate disaster. While the global Covid-19 pandemic temporarily dampened global greenhouse gas emissions in 2020, they increased in 2022.[6] At COP27, nations lamented the lack of progress in reducing emissions and also discussed ways to finance clean energy for developing countries in particular.[7]

In a 2021 study,[8] the IEA estimated that nuclear power’s contribution to the world energy supply would need to double by mid-century to achieve deep decarbonization. As part of that deployment, the IEA estimated the nuclear sector would need an average investment of around $90 billion per year from 2021 to 2030, $94 billion per year from 2031 to 2040, and $80 billion per year from 2041 to 2050—amounts that are more than double the global average investment of $36 billion per year from 2016 to 2020.

Nuclear power might grow as part of decarbonization efforts for various reasons. In particular, analysis has shown that the presence of “firm” low-carbon energy options—that is, technologies that can produce power upon customer demand at any time of year for as long as required, such as that from nuclear power plants—lowers the costs of transitioning to a reliable, low-carbon grid, in part by avoiding large overbuilds of storage and variable renewable energy sources. One study found that electricity costs were reduced by 10 to 62 percent across fully decarbonized cases when firm low-carbon options were available.[9]

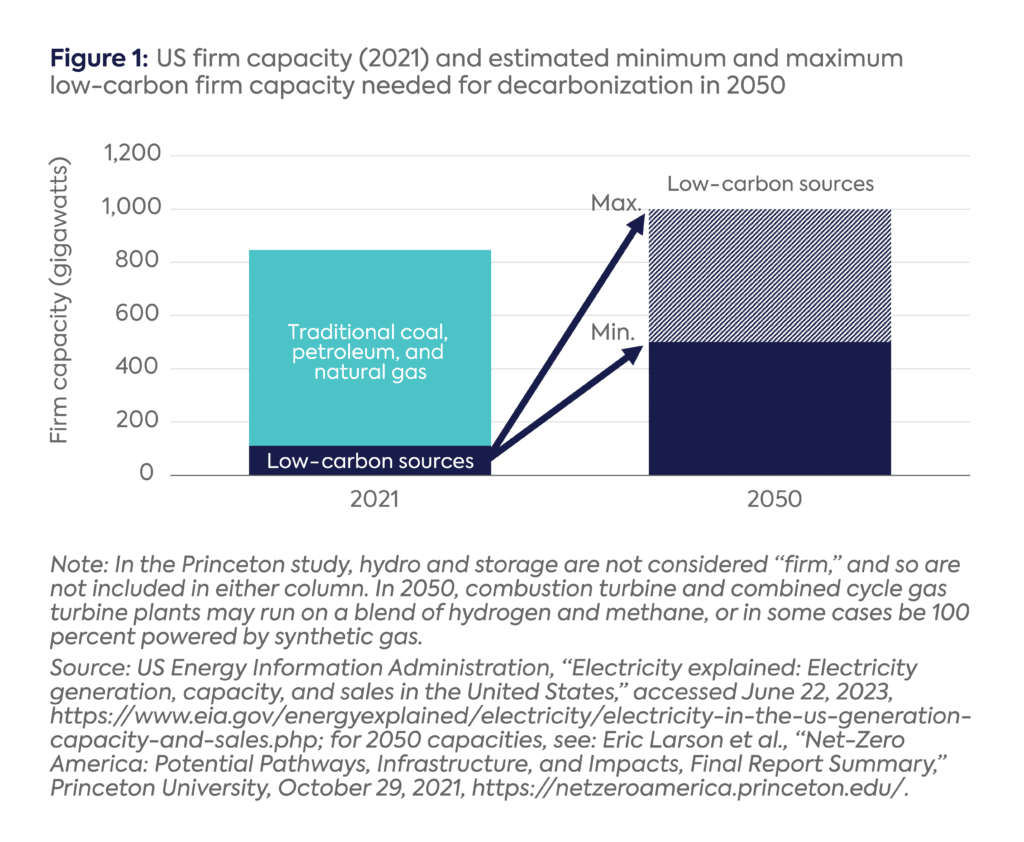

Further, a recent Princeton study modeled total US electricity generation as more than doubling under all of the economy-wide decarbonization scenarios that were considered, given increased electrification of non-power sectors such as transportation.[10] In all of those scenarios, Princeton estimated that the US electrical grid would need between 500 and 1,000 gigawatts (GW) of low-carbon firm generating capacity. The US electrical grid has a comparable amount of firm power today—around 800 GW—but that power mostly comes from traditional fossil plants that are not low-carbon. In the Princeton report, various combinations of different firm low-carbon energy sources—biomass, gas turbines using zero-carbon hydrogen, nuclear energy, and fossil energy plants equipped with carbon capture and sequestration—made up 500 to 1,000 GW of capacity in 2050. Princeton’s estimated lowest overall cost scenario for the US reaching a decarbonized energy supply by mid-century involved a substantial nuclear build program, and the investment needed to support this level of nuclear deployment could total more than $1 trillion.[11]

In 2021, most US firm capacity was provided by traditional fossil fuel plants that emit greenhouse gases (see Figure 1). If the Princeton modeling is at least notionally correct, utilities would need to build hundreds of gigawatts of low-carbon firm power (or put in place retrofits at existing fossil energy sites) by 2050 to achieve decarbonization while maintaining affordable, reliable electricity supply. Nuclear energy is one candidate for that low-carbon firm capacity, and is the only one currently deployed at large scale—i.e., 93,000 megawatts (MW), compared with 15,000 MW for biomass and geothermal.

The US Congress recognized in the Inflation Reduction Act (IRA) of 2022 that a combination of low-carbon energy sources will be needed, and included in the law incentives such as a new technology-neutral investment tax credit that would apply to both new nuclear and new renewable energy projects. As a recent US Department of Energy (DOE) report noted, delays in deploying nuclear at scale could lead to missed decarbonization targets.[12]

The IRA followed the Infrastructure Investment and Jobs Act of 2021, which established a program to keep existing nuclear power plants in the United States running. In November 2022, the DOE conditionally awarded Diablo Canyon in California $1.1 billion to keep the power plant in operation.[13] Analyses consistently find that reaching zero emissions will be easier and happen earlier if existing nuclear plants stay on the grid longer.[14]

Climate finance taxonomies are classification systems that identify activities considered to be within a climate-aligned or green economic category, usually when they are deemed to contribute to mitigation of or adaptation to climate-change-related impacts.[15] Taxonomies can guide investors and capital providers in identifying areas for investment and mobilizing capital toward sustainable activities—they are not meant to substitute fundamental credit analysis and risk management. Issuers of green or sustainable bonds may voluntarily choose to obtain a second party opinion (a commissioned review and assessment on its green or sustainable bond framework or issuance) to capture a broader range of investors who may require the external verification as an investment criterion.

As mentioned earlier, despite nuclear energy’s potentially critical role in supporting deep decarbonization of the global economy, it is more commonly excluded from climate finance taxonomies, or the taxonomies are ambiguous on the issue. Thus, whether nuclear energy is considered green and sustainable or not varies widely across regions and institutions. For example, as shown in a review of the 30 global systemically important banks,[16] 57 percent have explicitly excluded nuclear energy from their respective green or sustainable financing frameworks’ taxonomies, while 40 percent are silent on its inclusion or exclusion (see Table 1).

Even within a regional intergovernmental organization there may be a variation in views among sovereigns. For example, within the EU, France[17] and Germany[18] have excluded nuclear as a permissible use of proceeds from recent sovereign green bond issuances, despite nuclear’s inclusion in the EU taxonomy.[19] In Asia, countries such as India[20] and Indonesia[21] have excluded nuclear, while China[22] and South Korea[23] have included it. South Korea updated its K-Taxonomy draft to include nuclear energy in September 2022,[24] while China included nuclear energy in its 2021 Industry Catalogue, which is a list of industries considered by its regulators as “green”; projects within these industries may be eligible to use proceeds from green bonds in China.[25]

The UK government’s Green Financing Framework as of June 2021[26] explicitly excludes nuclear energy, citing recognition of exclusionary criteria for nuclear energy by many sustainable investors. Another notable set of capital providers that exclude nuclear energy are multilateral development banks, such as the World Bank.

The EU’s taxonomy does stipulate conditions for labeling nuclear energy activities as “green,” including requiring a new plant receive construction permit approval before 2045 and be located in a country with plans to dispose of radioactive waste by 2050, as well as associated funding provisions.[27] Life extension upgrades and modifications for existing nuclear power plants qualify only until 2040.[28]

Some utilities within countries that don’t allow nuclear to qualify as green for their own sovereign bonds do allow it themselves, such as Électricité de France, which updated its green bond framework to include nuclear energy.

Some financial sector groups have also expressed positions regarding nuclear energy. One example is the Principles for Responsible Investment (PRI), which has more than 5,300 investment management and asset owner signatories representing over $121 trillion in assets under management. PRI was critical[29] of the EU’s inclusion of nuclear energy in its taxonomy, citing concerns related to safety, waste management, and proliferation.[30] A second example is the International Capital Market Association (ICMA), which defines the widely used Green Bond Principles. While ICMA caveats that it does not intend to fully prescribe a taxonomy, it provides a non-exhaustive (“includes but is not limited to”) list of eligible green project categories that does not include nuclear energy.[31]

Taxonomy matters because sustainable investing assets under management were estimated to have reached $35 trillion at the end of 2021 and are expected to grow to $50 trillion by 2025.[32] Due to the tremendous growth and continued momentum projected for sustainable investment, nuclear energy would likely benefit from being able to access this pool of capital. A transaction involving Brookfield Renewable and Cameco jointly acquiring 100 percent of Westinghouse—a company that designs power reactors and provides nuclear equipment and services—for approximately $4.5 billion is a recent example of this. Brookfield Renewable executed the transaction through its energy-transition-focused fund, which is the largest of its kind in the world.[33] Apart from investments in new nuclear projects, capital will also be needed to keep the existing fleet of reactors in operation, including for safety equipment upgrades, new advanced nuclear fuels with greater safety margins, and replacing/refurbishing equipment as it ages.

(Of course, it’s not just taxonomies that are keeping some money out of nuclear. During a recent Center on Global Energy Policy roundtable discussion on climate financing and nuclear energy, some individuals from the finance industry voiced the opinion that while the inclusion of nuclear in climate taxonomies would be helpful in the long run for nuclear energy to contribute to decarbonization, other fundamental headwinds prevent more capital from flowing into nuclear, including the poor record of delivering projects on time and on budget and the lack of progress on spent nuclear fuel disposal.[34])

The disconnect between modeled pathways for reaching deep decarbonization of the global energy system that include nuclear and the common exclusion of nuclear in climate finance taxonomies highlights a challenge to be addressed.

Groups that develop and publish climate taxonomies would likely find it useful to talk with utilities about the reliability metrics they are required to meet in providing electricity to their customers, how they go about meeting those metrics, and what it will take for carbon emissions to be eliminated from the power sector by mid-century while maintaining affordability and reliability. Utilities would be well positioned to explain in particular the role of firm low-carbon power in achieving those aims. Discussions with utilities and other experts from different regions of the United States and different parts of the world would also be useful, as some firm low-carbon options (including nuclear power) will have varying availabilities based on location.

Climate finance groups could also spend some time understanding the challenges to decarbonization outside of the power sector, where electricity from solar panels and wind turbines does not look as promising in replacing high-temperature heat currently made by burning fossil fuels as nuclear does.[35]

Additionally, environmental groups could consider prioritizing the elimination of energy sources with the most negative environmental and public health impacts first—like the traditional use of coal, oil, and gas, given their associated greenhouse gas intensities and air pollution. Even remaining neutral on nuclear power’s inclusion in climate finance taxonomies could allay banks’ and investment firms’ concerns about being accused of “greenwashing” if they include nuclear power in their taxonomies.

At the end of the day, not many new reactors will be built if the nuclear industry cannot keep reactor construction reasonably close to planned schedules and costs and governments aren’t making progress in the disposition of nuclear waste. But in the face of an existential threat, including nuclear power in climate taxonomies as a low-carbon, firm power source in a decarbonizing world would increase its access to a large pool of sustainable investment to help meet net zero emissions targets by mid-century.

[1] See the European Commission’s “EU Taxonomy Navigator” webpage: https://ec.europa.eu/sustainable-finance-taxonomy/.

[2] Esteban Duarte, “OPG Sells Nuclear Power Green Bonds in Canadian Dollars,” Bloomberg, July 14, 2022, https://www.bloomberg.com/news/articles/2022-07-14/opg-kicks-off-nuclear-power-green-bond-sale-in-canadian-dollars.

[3] International Energy Agency, World Energy Outlook 2022, https://www.iea.org/reports/world-energy-outlook-2022.

[4] International Atomic Energy Agency, “‘Nuclear Is Making a Strong Comeback,’ IEA’s Birol Tells IAEA Director General Grossi at IAEA COP27 Event,” November 9, 2022, https://www.iaea.org/newscenter/news/nuclear-is-making-a-strong-comeback-ieas-birol-tells-iaea-director-general-grossi-at-iaea-cop27-event.

[5] Damian Carrington, “Carbon Emissions from Fossil Fuels Will Hit Record High in 2022,” Guardian, November 11, 2022, https://www.theguardian.com/environment/2022/nov/10/carbon-emissions-from-fossil-fuels-will-hit-record-high-in-2022-climate-crisis.

[6] International Energy Agency, “Global CO2 Emissions Rose Less than Initially Feared in 2022 as Clean Energy Growth Offset Much of the Impact of Greater Coal and Oil Use,” March 2, 2023, https://www.iea.org/news/global-co2-emissions-rose-less-than-initially-feared-in-2022-as-clean-energy-growth-offset-much-of-the-impact-of-greater-coal-and-oil-use.

[7] Center on Global Energy Policy, “Mobilizing Finance for Clean Energy in Emerging Markets,” November 8, 2022, https://www.energypolicy.columbia.edu/events-calendar/cgep-cop27-mobilizing-finance-clean-energy-emerging-markets.

[8] International Energy Agency, Net Zero by 2050, https://www.iea.org/reports/net-zero-by-2050.

[9] Nestor Sepulveda, Jesse D. Jenkins, Richard Lester, and Fernando de Sisternes, “The Role of Firm Low-Carbon Electricity Resources in Deep Decarbonization of Electric Power Generation,” Joule 2, no. 11 (2018): 2403–2420, https://doi.org/10.1016/j.joule.2018.08.006.

[10] Eric Larson et al., “Net-Zero America: Potential Pathways, Infrastructure, and Impacts, Final Report Summary,” Princeton University, October 29, 2021, https://netzeroamerica.princeton.edu/.

[11] In scenario E+RE-, which Princeton estimated as the least costly, over 200 GW of new nuclear is built. As a rough estimate, assuming $6,000/kW as the average overnight cost for this deployment, this would imply on the order of $1.2 trillion in investment.

[12] US Department of Energy, “Pathways to Commercial Liftoff: Advanced Nuclear,” March 2023, https://liftoff.energy.gov/wp-content/uploads/2023/03/20230320-Liftoff-Advanced-Nuclear-vPUB-0329-Update.pdf.

[13] Stephen Singer, “DOE Conditionally Awards PG&E’s Diablo Canyon Nuclear Plant $1.1B to Forestall Shutdown,” Utility Dive, November 21, 2022, https://www.utilitydive.com/news/diablo-canyon-doe-pge-retire-funding-credit-program/637040/.

[14] Rhodium Group, “Pathways to Build Back Better: Investing in 100% Clean Electricity,” March 23, 2021, https://rhg.com/research/build-back-better-clean-electricity/.

[15] Global Financial Markets Association, “Global Guiding Principles for Developing Climate Finance Taxonomies: A Key Enabler for Transition Finance,” June 2021, https://www.gfma.org/wp-content/uploads/2021/06/global-principles-for-climate-taxonomy.pdf.

[16] Banks reviewed constitute the 30 global systemically important banks (G-SIBs) as of November 21, 2021. Financial Stability Board, “2021 List of Global Systemically Important Banks (G-SIBs),” accessed December 1, 2022, https://www.fsb.org/2021/11/2021-list-of-global-systemically-important-banks-g-sibs/. The respective green or sustainability bond frameworks for each bank identified as a G-SIB was reviewed. G-SIBs are banks that qualify under the Basel Committee on Banking Supervision’s methodology for determining banks that have systemically important profiles based on criteria such as size, complexity, and interconnectedness. G-SIBs are used as examples in this commentary as these are financial institutions with some of the largest capital sources that may be available for deployment for financing.

[17] République Française, “Framework for the Green OAT,” January 10, 2017, https://www.aft.gouv.fr/files/archives/attachments/25562.pdf; OECD Library, “Sustainable Finance Definitions in France,” https://www.oecd-ilibrary.org/sites/4e906719-en/index.html?itemId=/content/component/4e906719-en.

[18] Bundesrepublik Deutschland Finanzagentur GmbH, “Federal Republic of Germany Green Bond Investor Presentation,” August 2022, https://www.deutsche-finanzagentur.de/fileadmin/user_upload/Institutionelle-investoren/green/presentations/Green_Bond_Investor_Presentation_2022_II.pdf.

[19] Official Journal of the European Union, “Commission Delegated Regulation (EU) 2022/1214 as of 9 March 2022 amending Delegated Regulation (EU) 2021/2139 as regards economic activities in certain energy sectors and Delegated Regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities,” July 15, 2022, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32022R1214&from=EN.

[20] Government of India, “Framework for Sovereign Green Bonds,” 2022, https://dea.gov.in/sites/default/files/Framework%20for%20Sovereign%20Green%20Bonds.pdf.

[21] Republic of Indonesia, “The Green Bond and Green Sukuk Framework,” https://www.sec.gov/Archives/edgar/data/1719614/000119312518070289/d714087dex99k.htm.

[22] Nicholas Pfaff, Ozgur Altun, and Yanqing Jia, “Overview and Recommendations for Sustainable Finance Taxonomies,” International Capital Market Association, May 2021, https://www.icmagroup.org/assets/documents/Sustainable-finance/ICMA-Overview-and-Recommendations-for-Sustainable-Finance-Taxonomies-May-2021-180521.pdf.

[23] Susan Lee, “Seoul Officially Includes Nuclear Energy in Green Taxonomy,” Pulse News Korea, September 20, 2022, https://pulsenews.co.kr/view.php?year=2022&no=829714.

[24] “Nuclear Power Included in Revised Green Taxonomy,” Korea Times, September 21, 2022, https://www.koreatimes.co.kr/www/nation/2022/09/113_336441.html.

[25] Pfaff et al., “Overview and Recommendations for Sustainable Finance Taxonomies,” https://www.icmagroup.org/assets/documents/Sustainable-finance/ICMA-Overview-and-Recommendations-for-Sustainable-Finance-Taxonomies-May-2021-180521.pdf.

[26] United Kingdom Debt Management Office, “UK Government Green Financing Framework,” June 2021, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1002578/20210630_UK_Government_Green_Financing_Framework.pdf.

Notable excerpt: “Recognising that many sustainable investors have exclusionary criteria in place around nuclear energy, the UK Government will not finance any nuclear energy-related expenditures under the Framework. The UK Government, however, recognises that reaching net zero emissions will require all energy to be delivered to consumers in zero-carbon forms and be derived from low carbon sources. Nuclear power is, and will continue to be, a key part of the UK’s low-carbon energy mix alongside solar and wind generation and carbon capture and storage.”

[27] Kate Abnett, “EU Proposes Rules to Label Some Gas and Nuclear Investments as Green,” Reuters, February 2, 2022, https://www.reuters.com/business/sustainable-business/eu-proposes-rules-label-some-gas-nuclear-investments-green-2022-02-02/.

[28] European Commission, “EU Taxonomy: Accelerating Sustainable Investments,” February 2, 2022, https://commission.europa.eu/system/files/2022-02/sustainable-finance-taxonomy-complementary-climate-delegated-act-factsheet_en.pdf.

[29] For example, PRI cites in its position paper published in November 2021 that “nuclear energy’s potential substantial contribution to climate mitigation is clear, but criteria to ensure that current nuclear technology ‘does no significant harm’ to other environmental objectives as required by the Taxonomy Regulation, remain elusive.”

[30] Principles for Responsible Investment, “Alternative Solutions to Include Gas-Fired Power and Nuclear Energy in the EU Sustainable Taxonomy,” November 19, 2021, https://www.unpri.org/policy-reports/alternative-solutions-to-include-gas-fired-power-and-nuclear-energy-in-the-eu-sustainable-taxonomy/9023.article.

[31] Pfaff et al., “Overview and Recommendations for Sustainable Finance Taxonomies,” https://www.icmagroup.org/assets/documents/Sustainable-finance/ICMA-Overview-and-Recommendations-for-Sustainable-Finance-Taxonomies-May-2021-180521.pdf.

[32] Saijel Kishan, “ESG by the Numbers: Sustainable Investing Set Records in 2021,” Bloomberg, February 2, 2022, https://www.bloomberg.com/news/articles/2022-02-03/esg-by-the-numbers-sustainable-investing-set-records-in-2021.

[33] Brookfield Renewable, “Cameco and Brookfield Renewable Form Strategic Partnership to Acquire Westinghouse Electric Company,” press release, October 11, 2022, https://bep.brookfield.com/press-releases/bep/cameco-and-brookfield-renewable-form-strategic-partnership-acquire-westinghouse.

[34] Matt Bowen and Kat Guanio, “Climate Finance Taxonomies and Nuclear Energy: Roundtable Report,” Center on Global Energy Policy, January 2023, https://www.energypolicy.columbia.edu/publications/climate-finance-taxonomies-and-nuclear-energy-roundtable-report.

[35] S. Julio Friedmann, Zhiyuan Fan, and Ke Tang, “Low-Carbon Heat Solutions for Heavy Industry: Sources, Options, and Costs Today,” Center on Global Energy Policy, October 2019, https://www.energypolicy.columbia.edu/research/report/low-carbon-heat-solutions-heavy-industry-sources-options-and-costs-today; see also recent comments by the Dow chairman and CEO on how advanced nuclear could help the company decarbonize operations at one of its manufacturing plants: https://www.cnbc.com/video/2023/05/12/dow-ceo-jim-fitterling-on-advanced-nuclear-reactor-project-in-texas.html.

The United States is at a rare inflection point for nuclear energy, with unprecedented momentum behind deployment and regulatory reform as nuclear becomes central to energy security, AI competitiveness, and state and corporate climate goals.

The NRC is already experimenting and making improvements in reducing licensing review times without changing the diligence or substance of its evaluations, and the results are promising. If the projected volume of applications materializes, the NRC will need to continue to apply the new approaches it has begun using, as well as seek out additional efficiencies. This paper lays out actionable recommendations on what NRC can do now—under existing statutory authority—to further compress schedules while preserving safety, due process, and analytical quality.

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

Full report

Commentary by Matt Bowen & Kat Guanio • July 06, 2023