This article was first published on KNect365 Energy. It was also republished at Lloyd’s...

This article was first published on KNect365 Energy. It was also republished at Lloyd’s List.

According to Wood Mackenzie Ltd. burgeoning American LNG supplies accounted for almost 7 percent of China’s LNG imports in March of 2017, and a recent Forbes article by Jude Clemente predicts significant growth for US LNG imports to China over the next few decades. Why? He cites factors such as: natural gas pricing, air pollution and the ongoing development of China’s economy. Clemente prophesizes: “Just imagine the possibilities: if the Chinese ever consume like Americans, global gas demand would effectively double.”

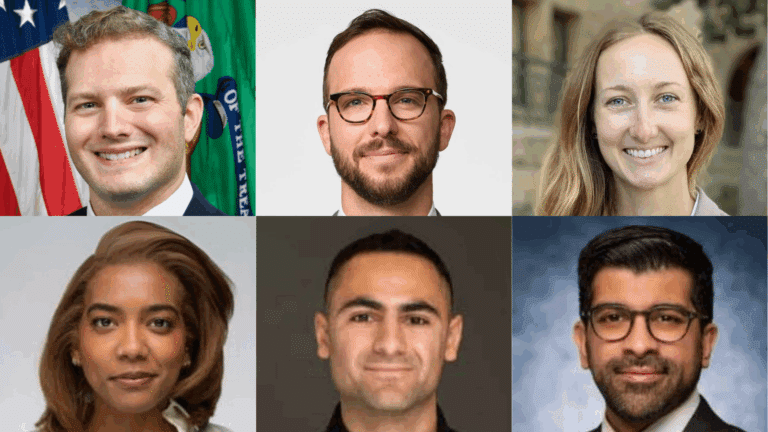

To investigate further, I asked several Global energy thought leaders what they think LNG demand in China will look like in the short and long term and where they think US LNG might fit in.

Tim Boersma, Senior Research Scholar, Director of Global Natural Gas Markets, Columbia University, @TimBoersma4

“The 2016 boom in Chinese LNG imports was mainly the result of contractual shipments from Australia ramping up (a trend which will continue in the coming years) and some spot purchases to meet higher than expected seasonal demand in the winter. Most US spot cargoes were also sold in the Dec 2016-Feb 2017 period to China. The structural demand for gas in the Chinese energy sector is mainly driven by policy, namely the government’s efforts to increase the share of gas in the country’s energy mix (to 10% by 2020), the forced conversion of small coal-fired boilers to gas-fired ones (mainly in residential and industrial applications) and the connection of rural households to the gas distribution grid.”

“Over time, gas has great growth potential in the Chinese energy system, as its penetration is very low compared to other developed economies in the power, industrial and residential/commercial sectors alike. Further deregulation of domestic gas markets in China could create additional demand for natural gas in the future. But LNG is only one way to meet this growing demand. Domestic production from the country’s prolific shale gas plays has been initially disappointing, and the challenging conditions suggests that China will not see an American-style shale gas revolution anytime soon, if at all. But if domestic production ramps up meaningfully over time, then domestic gas will most likely be prioritized over imported LNG. Pipeline gas imports come from various sources, including Turkmenistan, Myanmar, and, in time, likely Russia, and most of these resources will be able to compete with LNG and / or be tied up in long-term take-or-pay contracts.”

“To the extent there will be continued demand growth and China decides to meet it with LNG, US LNG can fit in the Chinese energy system in two ways. It can be in the form of spot purchases from US LNG offtakers (e.g. from Shell’s portfolio) and marketing arms of terminal operators (e.g. Cheniere Marketing), as happened this winter in response to increased demand due to the cold weather. This type of demand will be somewhat unpredictable (and periodic at best), depending on when unexpected demand arises on top of China’s contractual LNG supplies. The other type will be in the form of long-term offtake agreements with US LNG exporters. A recent trade agreement between the Trump administration and China reinforced the existing policy that US LNG exports under such long-term contracts will be treated as exports to any other non-free trade agreement countries. It is not impossible that Chinese buyers will sign such long-term contracts with US sellers, but it should be emphasized that China currently has fairly high contract coverage for the foreseeable future. Only faster-than-expected LNG demand growth (and sufficiently high confidence in high long-term demand) would justify signing additional contracts on top of the existing ones.”