This website uses cookies as well as similar tools and technologies to understand visitors’ experiences. By continuing to use this website, you consent to Columbia University’s usage of cookies and similar technologies, in accordance with the Columbia University Website Cookie Notice.

Energy Explained

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

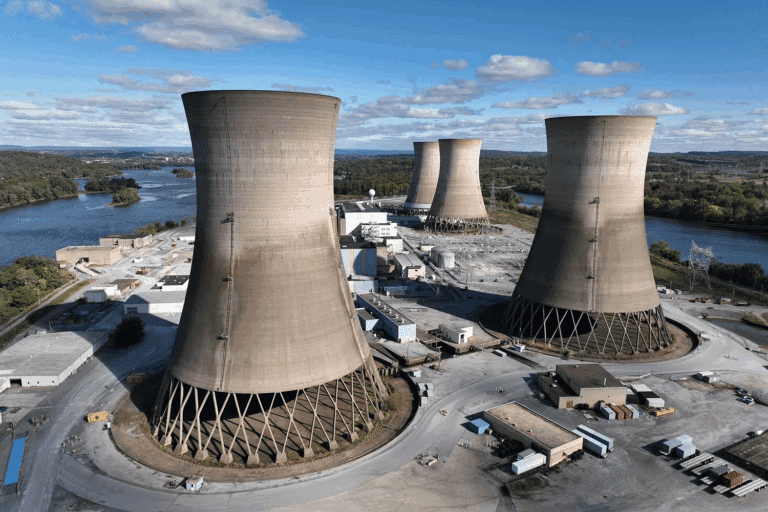

Poland’s nascent nuclear energy program is advancing: in late September, Polskie Elektrownie Jądrowe (PEJ), the utility tasked with constructing the country’s first nuclear plant by the Polish Ministry of Climate and Environment, signed an engineering services contract with Westinghouse and Bechtel to design the reactor.[1] This would be a welcome development for the Biden administration, which is keenly interested in reviving the United States’ lost competitiveness in the global civil nuclear export market for climate and geopolitical reasons.[2]

Few forecasts see the world reaching global climate goals without a massive buildout of nuclear energy. Moreover, the supplier matters: Russia dominates civil nuclear exports,[3] with China poised to play a greater role in the future, and both could leverage this competitiveness to influence countries with their geopolitical goals at the expense of US interests. From the US perspective, Poland—and Eastern Europe more broadly—offers a friendly terrain for US nuclear revival. For its part, Poland sees nuclear energy as least disruptive to its economic and national security goals in the face of its binding obligations to cut emissions as an EU member state.

Warsaw may be a first mover, but there are other European Union countries with similar attributes. In this article, the authors discuss Warsaw’s motives and prospects for adopting nuclear energy. Understanding the Polish perspective is critical to unlocking the market opportunity—with the US ramping up coal-to-nuclear support throughout Eastern Europe, including in Czechia, Slovakia, and Poland.[4]

Geopolitical Factors

Poland’s geopolitical calculus is underpinned by a desire for closeness with the US and antipathy toward Russia that predates Moscow’s invasion of Ukraine. In a 2022 poll, 91 percent of respondents in Poland had a favorable opinion of the US (compared to 63 percent in Germany and Canada).[5] In contrast, nearly all Poles negatively view Russia.[6] The US nuclear export strategy aligns well with Poland’s foreign policy, as it leverages a distrust of Russia and relies on its own diplomatic standing in that country. Polish lawmakers from across the political spectrum support strategies that reduce dependency on Russian energy and promote closer economic ties with Washington. For example, Poland was among the first EU countries to displace imports of Russian gas with LNG, starting this shift in the past decade.[7] Importing US nuclear technologies is a natural extension of that strategy, albeit better aligned with Poland’s climate commitments.

Energy Transition Goals

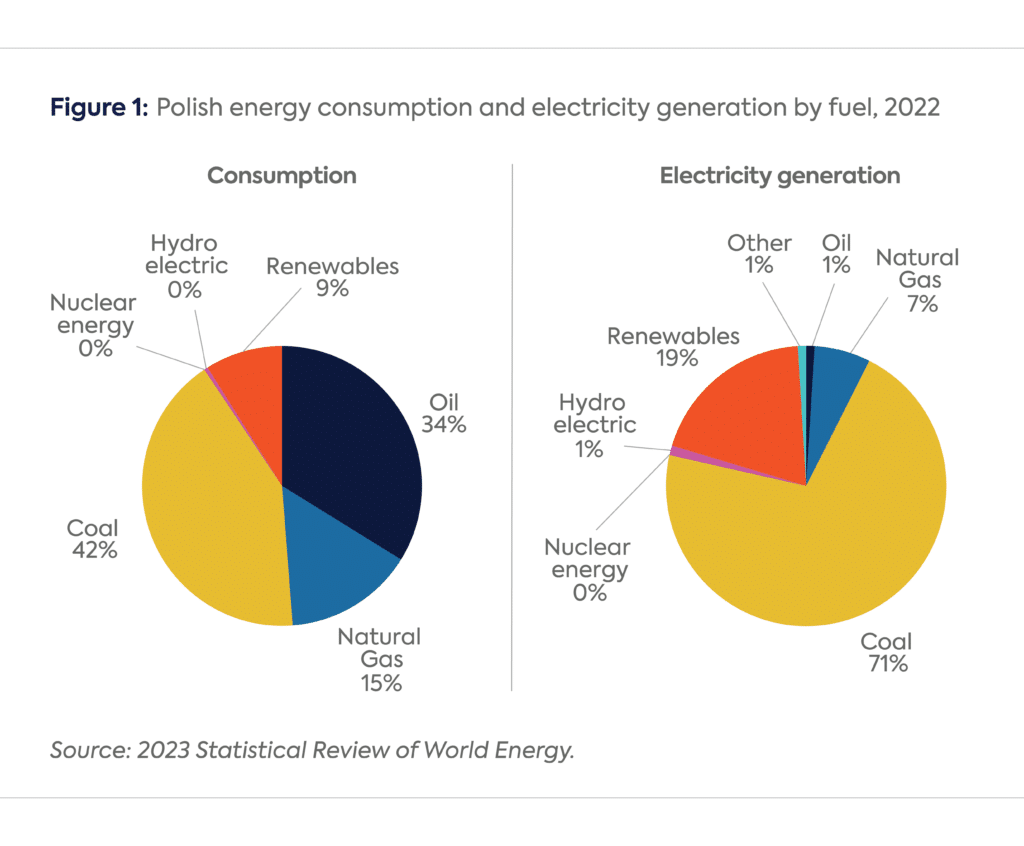

Warsaw sees nuclear energy as necessary for an economically stable energy transition. Poland is extremely reliant on coal, sourcing more than 70 percent of its electricity from it (Figure 1). It is home to the second-largest coal generation fleet in the EU, which fuels its manufacturing-heavy economy and workforce.[8] This has contributed to Poland having some of the worst air pollution in Europe.[9] Renewable alternatives like wind and solar have grown rapidly in the last several years, but Poland sees nuclear as a necessary complement. Reactors can provide dispatchable heat and power, making them well positioned to directly replace the coal fleet, which Poland currently relies on.

The US is also ramping up coal-to-nuclear support throughout Eastern Europe, including in Czechia, Slovakia, and Poland.[10] This assistance is aimed at small modular reactors (SMRs)—fundamentally different than the larger AP1000 design that Warsaw is advancing—but also of interest in Poland. In April, Poland’s Orlen Synthos Green Energy (a joint venture between chemical producers SGE and PKN Orlen) applied to the Ministry of Climate and Environment for a fundamental decision on six nuclear power plants with BWRX-300s.[11] In July, copper and silver producer KGHM Polska Miedz SA’s plan to construct a power plant using NuScale Power’s VOYGR SMR was approved by the Ministry of Climate and Environment.[12]

Cautious Optimism Amid Risks

Leaning on nuclear energy as the cornerstone of a national decarbonization strategy is hardly risk-free. The first AP1000s constructed in the United States endured large schedule and cost overruns, proving to be yet another cautionary tale. Moreover, Poland is a newcomer to the civil nuclear industry, which requires strong regulation and a specialized workforce. The Polish government, currently in transition,[13] must now license and construct commercial nuclear reactors for the first time.

Building gigawatt-class reactors is a daunting task even for countries with decades of reactor experience. But while Poland faces challenges to creating a civil nuclear energy program, there are reasons to expect that the AP1000 builds in Poland may be smoother and more efficient than in the United States.[14] Perhaps most importantly, the design of the AP1000 is now complete, which was far from the case when construction began in the United States.[15] Suppliers have experience manufacturing the major reactor components for the AP1000 (e.g., the coolant pumps and pressure vessels) and Bechtel, an engineering, procurement, and construction company with experience managing nuclear construction projects, will be guiding the project from start to finish.

PEJ’s announcement is a major step, but an interim one among many more before an AP1000 will provide electricity to the Polish grid. As the authors have previously outlined, Washington can do much to facilitate better financing terms. (Read “The Road to US Nuclear Energy Revival May Run through Warsaw” for insight on how the US could improve its offers to other countries.) Yet, there is no substitute for strong political will and geopolitical alignment when it comes to nuclear exports.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

Notes

[1] Nuclear Engineering International, “Poland signs contract for design of first NPP,” October 2, 2023. https://www.neimagazine.com/news/newspoland-signs-contract-for-design-of-first-npp-11186495

[2] Matt Bowen and Sagatom Saha, “The Road to US Nuclear Energy Revival May Run Through Warsaw,” May 23, 2023. https://www.energypolicy.columbia.edu/the-road-to-us-nuclear-energy-revival-may-run-through-warsaw/

[3] Matt Bowen and Alec Apostoaei, “Comparing Government Financing of Reactor Exports: Considerations for US Policy Makers,” August, 2022. https://www.energypolicy.columbia.edu/publications/comparing-government-financing-reactor-exports-considerations-us-policy-makers/

[4] U.S. Department of State, “Special Presidential Envoy for Climate Kerry Announces Project Phoenix Participants and the Nuclear Expediting the Energy Transition (NEXT) Program,” https://www.state.gov/special-presidential-envoy-for-climate-kerry-announces-project-phoenix-participants-and-the-nuclear-expediting-the-energy-transition-next-program/

[5] Richard Wike et al, “International public opinion of the U.S. remains positive,” June 22, 2022, https://www.pewresearch.org/global/2022/06/22/international-public-opinion-of-the-u-s-remains-positive/

[6] Jacob Poushter et al. “Spotlight on Poland: Negative Views of Russia Surge, but Ratings for U.S., NATO, EU Improve,” June 22, 2022. https://www.pewresearch.org/global/2022/06/22/spotlight-on-poland-negative-views-of-russia-surge-but-ratings-for-u-s-nato-eu-improve/

[7] International Energy Agency, “Poland 2022,” https://www.iea.org/reports/poland-2022

[8] Gavin Maguire, “Europe’s clashes over coal may extend well beyond Poland,” June 20, 2023, https://www.reuters.com/markets/commodities/europes-clashes-over-coal-may-extend-well-beyond-poland-2023-06-20/

[9] Rob Schmitz, “Poland is facing a coal shortage this winter,” NPR, December 6, 2022. https://www.npr.org/2022/12/06/1140894436/poland-is-facing-a-coal-shortage-this-winter

[10] U.S. Department of State, “Special Presidential Envoy for Climate Kerry Announces Project Phoenix Participants and the Nuclear Expediting the Energy Transition (NEXT) Program,” https://www.state.gov/special-presidential-envoy-for-climate-kerry-announces-project-phoenix-participants-and-the-nuclear-expediting-the-energy-transition-next-program/

[11] Nuclear Engineering International, “Poland’s Orlen Synthos Green Energy seeks formal approval for SMR sites,” May 2, 2023. https://www.neimagazine.com/news/newspolands-orlen-synthos-green-energy-seeks-formal-approval-for-smr-sites-10806865

[12] World Nuclear News, “Decision-in-principle for Polish SMR power plant,” July 13, 2023. https://world-nuclear-news.org/Articles/Decision-in-principle-for-Polish-SMR-power-plant

[13] Matthias Matthijs, “How Poland’s Election Results Could Reshape Europe,” Council on Foreign Relations, October 19, 2023. https://www.cfr.org/in-brief/how-polands-election-results-could-reshape-europe

[14] Matt Bowen, Rama T. Ponangi, Andrew Evans, “Vogtle Unit 3 Has Started Commercial Operations. What’s Next for the AP1000?” July 31, 2023. https://www.energypolicy.columbia.edu/vogtle-unit-3-has-started-commercial-operations-whats-next-for-the-ap1000/

[15] Anya Litvak, “Westinghouse Sold an Unfinished Product, then the Problems Snowballed,” Pittsburgh Gazette, October 23, 2017. https://www.post-gazette.com/business/powersource/2017/10/23/Westinghouse-sold-an-unfinished-product-then-the-problems-snowballed/stories/201710290008

More on Energy Explained Energy Explained

Assessing the Energy Impacts of the One Big Beautiful Bill Act

This special CGEP blog series, featuring six contributions from CGEP scholars, analyzes the potential impacts of the OBBBA across a range of sectors.

How Congress Can Build on SMR Momentum after Canada Approves First Commercial Construction for Such Reactors in North America

The Canadian Nuclear Safety Commission (CNSC) issued a construction license last week for what would be the first commercial small modular reactor (SMR)[1] in North America.

The Waste Isolation Pilot Plant Completes 25 Years of Operation

March 26, 2024, marks the 25th anniversary of operations at the Waste Isolation Pilot Plant (WIPP).

The Potential for Public-Private Partnerships in India’s Nuclear Electricity Program

Reuters recently reported that, for the first time, the Government of India will invite private companies to invest in nuclear electricity projects to ramp up growth in this important non-fossil electricity source.

Relevant

Publications

Energy Security Means Using Less Oil

The war with Iran shows why hopes for energy independence are inadequate.

New Developments in Nuclear Innovation Are in the Works

Nuclear innovation is projected to reach new heights between 2030 and 2035, but the effective implementation of President Trump's executive orders will determine their success or failure.

The United States Needs a Nuclear Operation Warp Speed

A nuclear energy resurgence is vital to meet rising electricity demand.