Could a strategic lithium reserve kickstart US supply chain development?

NEW YORK -- A strategic lithium reserve is being mooted as a solution to stabilize volatile prices that have hindered American mining projects, allowi

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author(s). It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision.

Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available here. Rare cases of sponsored projects are clearly indicated.

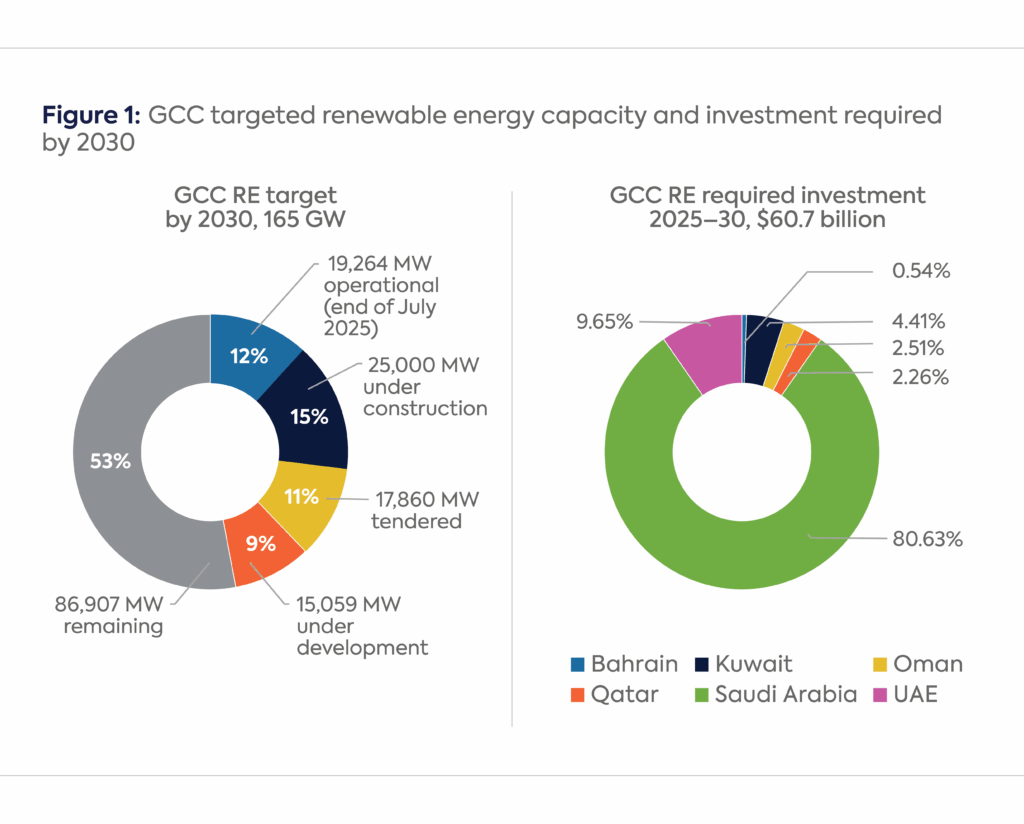

Gulf Cooperation Council (GCC) countries have not only the world’s lowest costs for oil and gas production but also the lowest costs for electricity generated from renewable energy sources. Aiming to increase the share of renewables in their energy mix, GCC countries have set ambitious goals for their energy transition and zero-emissions targets for 2030 and beyond, including 165 gigawatts (GW) of renewable energy capacity. The author estimates that the GCC market will need to invest $60 billion between 2025 and 2030 to add nearly 102 GW of renewable energy capacity, the remaining amount toward its goal.

This blog examines the current state of renewable energy development in GCC countries and identifies critical regulatory, technical, and financial challenges that must be addressed to meet the 2030 targets effectively. Governments will need to establish a competitive market structure for the emerging renewable energy sector to attract foreign investments, address technical challenges, and secure sustainable financial resources of an estimated $6 billion annually to fulfill long-term obligations of power purchase agreements.

The six GCC countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE) have invested over $42.5 billion in developing nearly 62.1 gigawatts (GW) of renewable energy projects. However, as of July 2025, only 19.3 GW of this capacity had been connected to the grid, which represents a small portion of the 2030 target of 165 GW. The author estimates that reaching that target will require an additional investment of nearly $60.7 billion (see Figure 1).[1] Notably, the Saudi market alone accounts for about 78 GW of the remaining capacity gap that must come online by 2030 or shortly thereafter, which will require around $48.9 billion of the additional investment.

Note: 1. These figures are subject to market fluctuations and individual country’s strategy changes. 2. The figure does not include 5.4 GW tendered by Saudi Arabia on September 15, 2025. 3. The approximate 102 GW referenced in the text refers to the “remaining” and “under development” segments of the capacity chart.

Source: Author calculations based on IRENA, EI, KAPSARC, and GCC national strategies. See endnote 1 for details.

Currently, 93 renewable energy projects in the GCC are in various stages of development. Among these, 46 projects are in Saudi Arabia, which include 39 solar photovoltaic projects and seven wind projects. Saudi Arabia began implementing an aggressive strategy this year to achieve its 2030 targets by tendering 20 GW of renewable energy of installed capacity annually, with between $10 and $12 billion of expected investment per year.[2]

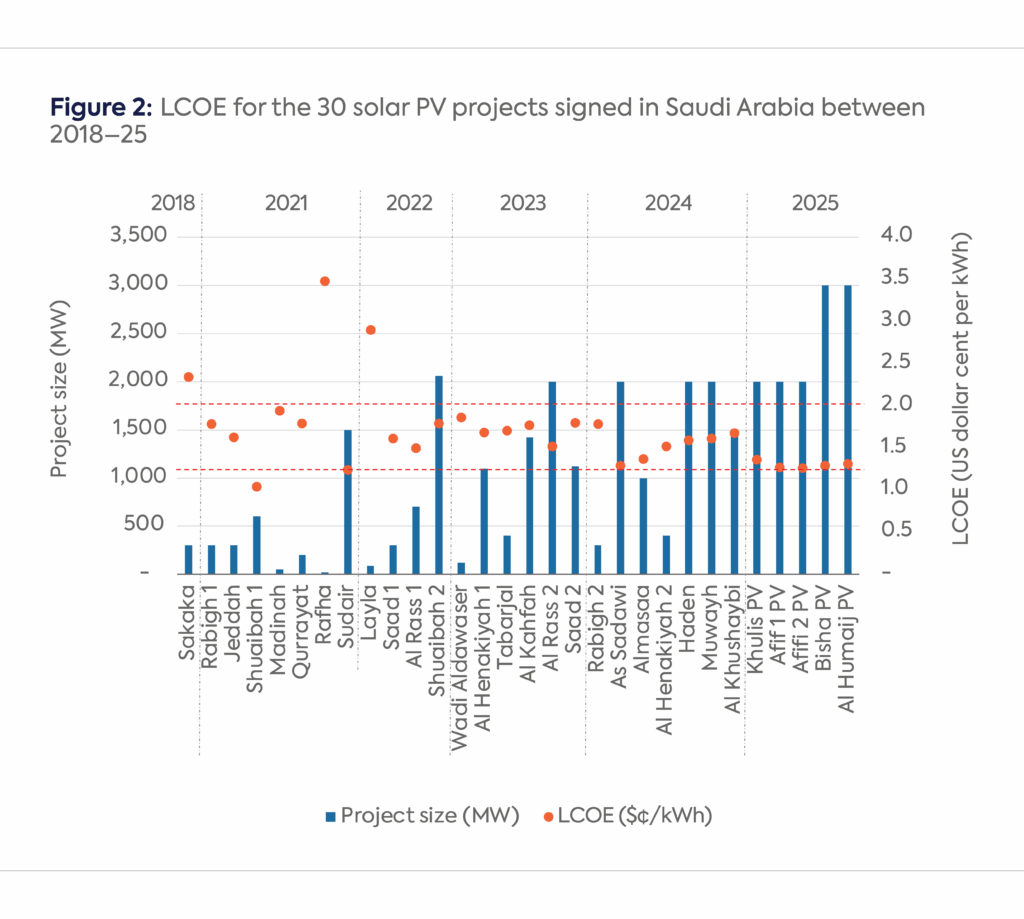

Ongoing developments and an extensive learning curve accumulated over nearly 10 years in the GCC market have led to new norms for the tendering process of renewable energy projects in terms of project size and levelized cost of electricity (LCOE). New project sizes in the GCC typically range from 1.0 to 3.0 GW, with average installation costs between $500,000 and $600,000 per megawatt (MW).[3] Additionally, the LCOE for solar photovoltaic stabilized between $0.012 and $0.019 per kilowatt-hour (kWh) in 2025 (see Figure 2),[4] while for wind energy, it ranges from $0.015 to $0.021 per kWh.[5]

Source: Author analysis based on data from the Saudi Ministry of Energy, ACWA Power, and PIF. See endnote 4 for details.

Although significant achievements have been made, the GCC’s path to its 2030 targets may still be encumbered by key regulatory, technical, and financial challenges.

Effective policies and regulations are crucial for creating a favorable investment environment in the GCC, particularly for foreign investors and international financial institutions but also for fostering confidence in local markets. Additionally, it is important to encourage participation of competitive project developers in the region. To tackle these challenges and boost capital inflow into GCC markets, a comprehensive set of policies need to be implemented by GCC governments, potentially including the following:

GCC countries will face the same key technical challenges arising from heavy reliance on renewable energy generation that any country would, including the intermittent and variable nature of wind and solar resources and issues with dispatchability, grid integration, and grid stability. GCC governments can take several actions to overcome or at least control technical challenges, including:

Financial challenges can be divided into two main categories: a project’s capital costs and the long-term financial obligations associated with the annual payments of power purchase agreements (PPAs), which typically last between 25 and 35 years.[6]

It often takes companies building solar photovoltaic projects a long time to go from signing PPAs to reaching financial closure. GCC governments in many cases have intervened to address funding gaps, reduce investment risks, and expedite the closure of these projects. In the GCC region, sovereign wealth funds (SWFs) have played a significant role in advancing projects that encounter such challenges.[7] However, in the long run, GCC governments must find sustainable approaches to overcome initial investment hurdles and, as noted, attract foreign investment to the region’s growing renewable energy sector.

The second financial challenge lies in obligations associated with PPAs, which will accumulate over time. Based on current market prices in the GCC and analysis of required installed capacity to meet the GCC’s 2030 renewable energy mix targets, the author projects that annual PPA obligations will exceed $6 billion. These agreements are heavily influenced by consumer demand for subsidized electricity, which accounts for up to 95 percent of the actual electricity production cost in countries like Kuwait[8] and Qatar.[9] The long-term nature of these agreements, combined with substantial subsidies from governments, creates significant financial stability risks and obligations for governments toward project developers and operators. GCC governments need to effectively manage these financial commitments and subsidies for the long-term economic sustainability of the renewable energy sector.

Financing renewable energy poses significant challenges due to the large number of projects offered and the substantial investments required, which are concentrated in a single market segment and geographical location. Possible approaches for GCC governments to secure, fully or partially, funds for upcoming projects, include the following:

[1] KAPSARC, KSA Renewables Tracker; Saudi Public Investment Fund, PIF – Our Portfolio – Public Investment Fund; UAE, UAE Energy Strategy 2050; Oman Ministry of Energy and Minerals, Renewable Energy and Hydrogen Projects; Saudi Power Procurement Company, Principal Buyer – Energy for Tomorrow; International Renewable Energy Agency, Renewable energy statistics 2025; International Renewable Energy Agency, Abu Dhabi, Renewable energy statistics 2025; Energy Institute, 2025 Statistical Review of World Energy. (All accessed September 25, 2025)

[2] S. Alhajraf, “Strategic Role of Sovereign Wealth Funds in the Gulf’s Energy Transition and Economic Diversification” Rice University’s Baker Institute for Public Policy, July 15, 2025, https://doi.org/10.25613/SWYJ-AC71.

[3] Saudi Gulf Projects, “Marubeni Led Consortium Signs 1,100 MW Wind Projects in Saudi Arabia,” May 21, 2024, https://www.saudigulfprojects.com/2024/05/marubeni-led-consortium-signs-1100gw-wind-projects-in-saudi-arabia/.

[4] Saudi Arabia Renewable Vision, Clean Energy Tracker, accessed September 25, 2025.

[5] Saudi Gulf Projects, “Marubeni Led Consortium Signs 1,100 MW Wind Projects in Saudi Arabia,” May 21, 2024, https://www.saudigulfprojects.com/2024/05/marubeni-led-consortium-signs-1100gw-wind-projects-in-saudi-arabia/.

[6] Public Investment Fund Utilities and Renewables, Leverage Saudi Arabia’s Natural Potential to Grow the Utilities and Renewables Sector, https://www.pif.gov.sa/en/strategy-and-impact/the-program/utilities-and-renewables/.

[7] S. Alhajraf, “Strategic Role of Sovereign Wealth Funds in the Gulf’s Energy Transition and Economic Diversification” Rice University’s Baker Institute for Public Policy, July 15, 2025, https://doi.org/10.25613/SWYJ-AC71.

[8] Kuwait Ministry of Electricity, Water, and Renewable Energy, Statistics Book 2023.

[9] E. Zaidan, L. Cochrane, and M. Al-Saidi, “Energy subsidies, consumption patterns and perceptions in Qatar: Comparative analysis on citizen and non-citizen residential energy use,” Environmental Challenges

20, September 2025, 101158, https://doi.org/10.1016/j.envc.2025.101158.

[10] ACWA Power, Al Shuaibah 1 and Al Shuaibah 2 Solar PV Independent Power Plant, Jeddah, KSA, https://www.acwapower.com/en/projects/shuaibah-pv-ipp/.

Two trade agreements recently negotiated by the Trump administration contain novel and coercive provisions with little precedent in US trade policy or the global trade system.

As the host of COP30, Brazil has an unprecedented platform to demonstrate its climate leadership.

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

World leaders are meeting in New York this month at the request of the United Nations Secretary-General António Guterres to discuss the state of global ambition on climate change.

New government documents seek to align the climate disclosures of Chinese companies with national priorities and global best practices. Edmund Downie (Princeton U) and Erica Downs (Columbia U) write for Shuang Tan.